What’s on

Free: walks, talks, comedy in London Bridge

Come along to the Medi-Culture Festival in London Bridge from 21 to 25 March. The line up includes Victorian surgery demos at the world’s oldest surviving operating theatre, medical stand-up and poetry from John Hegley.

Free: get household items fixed and learn new skills

You can get household items repaired, get your bike fixed or serviced, watch food waste cooking demonstrations and more at our Southwark Climate Day event in Elephant and Castle on Saturday 11 March. The High Commissioner for Fiji is one of our inspiring speakers too and you can debate big issues with experts.

Take a walk in Sydenham Hill Wood

Did you know there are woods in Southwark featuring the ruins of a monastery, wood sculptures, and an old railway path that winds its way through the trees? Sydenham Hill Wood, in SE26, has all this and more.

Mingle with eccentric Victorian characters in an immersive show

Enter the world’s first Victorian testing and experimenting works on London’s Bankside (SE1) for a surreal performance: ‘Facts not Opinions’: Stretched to the limit. From 30 March to 1 April. Tickets are £5 for Southwark residents.

Find a bargain at Peckham Salvage Yard

Hunt for vintage and antique gems at Peckham Salvage yard on Copeland Road on Sunday 12 March (£1 entry), near Peckham’s array of shops, cafés and bars.

Your health updates

Get help to lose weight: free virtual Weight Watchers support

If you’re 18 or over you may be eligible for 12 weeks’ free weight loss support. This includes virtual coaching and discounted gym membership. You’ll need to be a resident or be registered with a Southwark GP. Places are limited, apply today!

Cancer: know how to protect yourself

Reduce your risk of some cancers by moving more, eating well, being a healthy weight, cutting back on alcohol and quitting smoking. Cancer screening can help detect cancer early and can sometimes prevent cancer developing.

Last chance to get your free flu vaccine

The flu vaccine is offered every year through the NHS to help protect people at risk of getting seriously ill from flu. Flu vaccines are available until 31 March.

Help protect your child’s health, now and for future

The best way to help protect your child against severe illness from polio, flu, measles, mumps, rubella and other childhood diseases is to get them up to date with their routine vaccinations.

Cold weather: look out for those who might need a hand

Not everyone can cope in the cold. Look out for friends, family or neighbours who might need a hand.

Get your NHS Health Check booked if you’re 40 to 74

The free check can help spot early signs of stroke, kidney disease, heart disease, type 2 diabetes or dementia. You should get invited by your GP every five years. If not, you can contact your GP surgery to book one.

More updates

Easter holiday clubs for 4 to 16s: book now

If your child gets benefits-related free school meals they can join one of many summer of Food and Fun holiday clubs in Southwark. The clubs run fun activities and healthy and free food will be available.

Use a warm space in Southwark

As the cost of living and heating our homes increases, we’ve opened over 40 warm spaces across the borough. In these spaces you can keep warm, have a cup of tea or take part in an activity. Some spaces also offer food and cost of living advice too.

Join a free event and find out about our work to tackle racial injustice

We are hosting a week of events, from 20 March, as part of our Southwark Stands Together work (that aims to tackle the injustice and racism experienced by Black, Asian and minority ethnic communities). We have events focused on the arts, health inequalities, businesses and more in our offices near London Bridge.

You now need photo ID to vote at a polling station

From May 2023 you will need to show photo ID to vote in a polling station. Elections are not scheduled in Southwark until May 2024 but they could be called at any time. If you don’t have photo ID you can apply for a free voter ID document.

Building works reach the roof level at new development in Bermondsey

Our new development will provide 24 new homes, three retail spaces, garden areas and a roof garden in a five-storey building in SE1.

£50k available for projects in Elephant and Castle

Community groups working with people in Elephant and Castle can now apply for grants from a £50k fund. The fund is aimed at projects that promote health and wellbeing, help young people, provide training, or that help with the cost of living and sustainability.

Get your university tuition fees paid

If you’re aged under 25, and meet other criteria, you can apply to our Southwark Scholarship scheme. The scholarship award covers the full cost of tuition fees for your undergraduate university course.

Cost of living help

1. Come to a cost-of-living advice session in SE1

You can get advice from Citizens Advice Southwark, us and Jobcentre Plus on energy bills, welfare support, benefit payments, rent and Council Tax arrears, and more. Drop in anytime between 10am and 1pm on 30 March: Hankey Hall (Tabard Community Hall), 3 Hankey Place, SE1 4LR.

2. Don’t forget: redeem your £66/£67 vouchers if you have a pre-payment meter

If you have a pre-payment meter for energy bills, you should be getting help through the government’s support scheme. Most people get six vouchers (via text, email or post) worth £66 or £67 each. Don’t forget to redeem them at your usual top-up point, the vouchers expire after 90 days.

3. Get your energy bills discount (if you don’t get it automatically)

If you haven’t got the £400 discount on your energy bills automatically, for example if you live in a park home or houseboat, you can now apply to get it. If you’re eligible we will arrange a one-off payment (which might take at least six weeks). You don’t have to pay it back.

4. Free: advice to make your home energy efficient (for homeowners)

The Energy Advice Centre is a partnership between us and London Southbank University. It gives free expert advice on green home upgrades (such as solar panels) and retrofit measures (such as loft insulation).

5. You could get over £1,000 for healthy food and milk for your child

You could be eligible for the scheme if you’re aged:

• 18 or over and are pregnant, or have children under four years old and you get certain benefits

• Under 18, pregnant and don’t get benefits.

More cost of living help

|

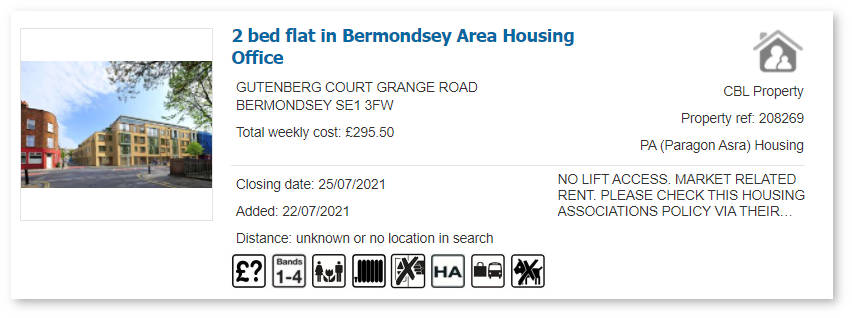

Image: Social rent homes at Gutenberg Court advertised at twice social rent levels

Image: Social rent homes at Gutenberg Court advertised at twice social rent levels Image: Planning statement for Gutenberg Court

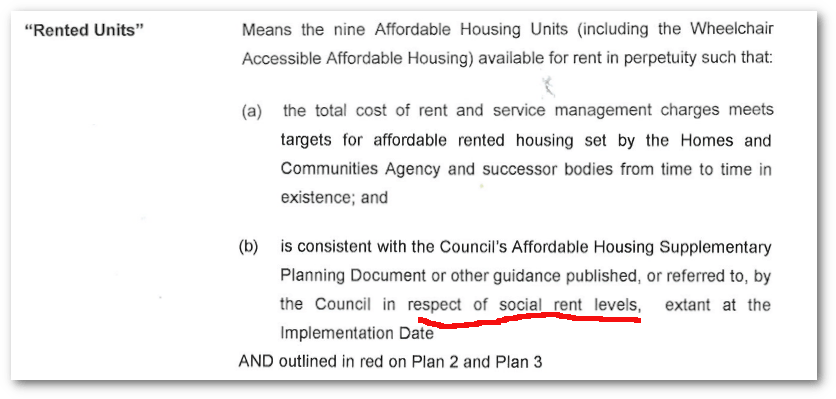

Image: Planning statement for Gutenberg Court Image: Section 106 agreement for Gutenberg Court

Image: Section 106 agreement for Gutenberg Court Image: Details of Mayoral funding for Gutenberg Court

Image: Details of Mayoral funding for Gutenberg Court

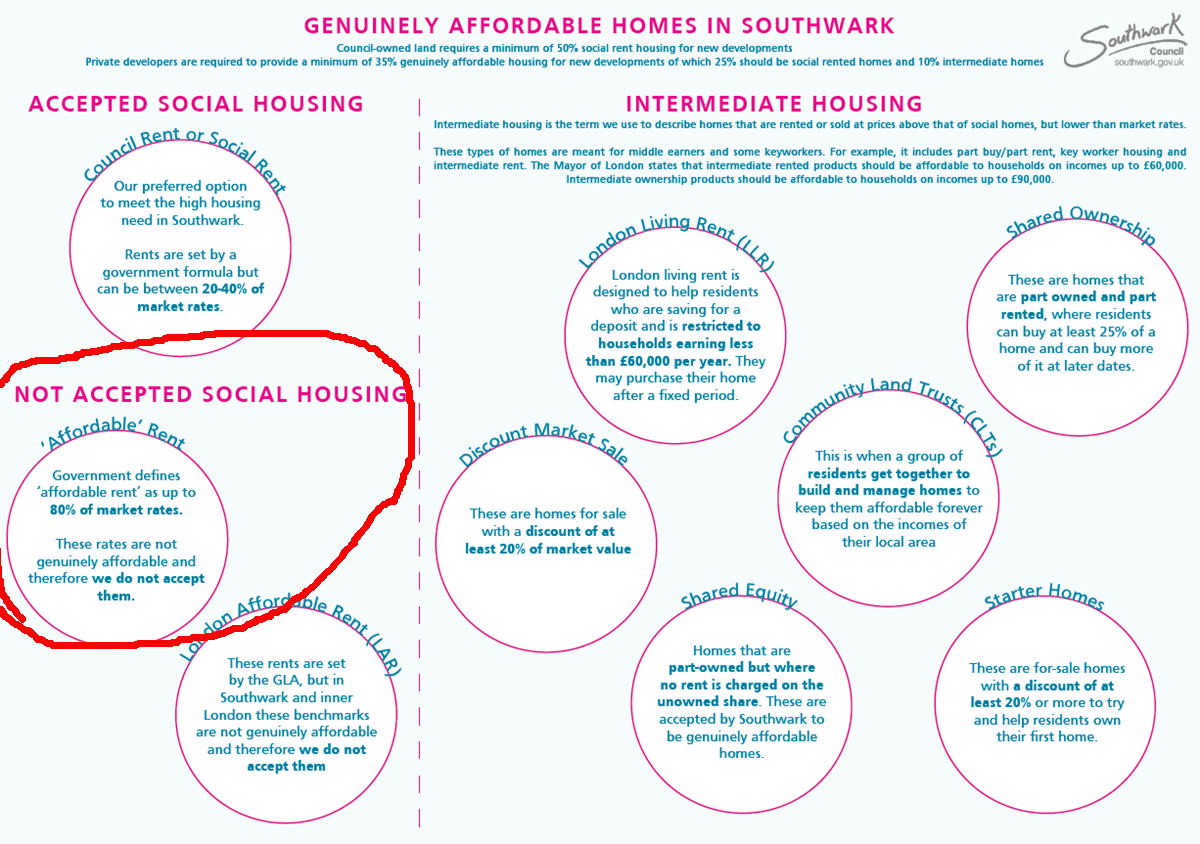

Image: Southwark’s

Image: Southwark’s