|

||||||||||||||||

Southwark Plan.

35% Campaign update – Lendlease’s final plot for Elephant Park – offices, not homes

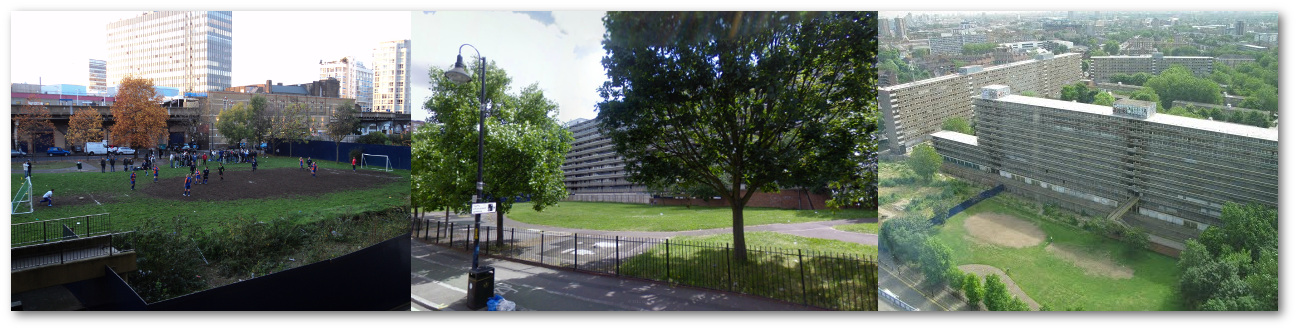

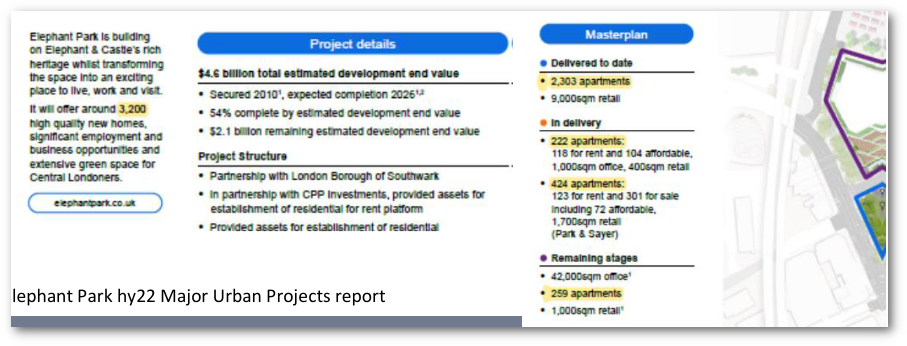

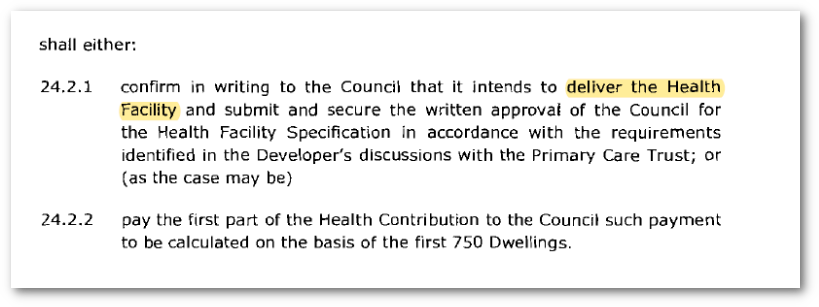

Sep 17, 2021 01:00 am Southwark to change rules to allow office block on former Heygate estate.Southwark Council is set to change its planning rules to enable developer Lendlease to build an office block on the site of the former Heygate estate. The block would be on the final development plot of Elephant Park, Plot H1, which is earmarked for housing under Lendlease’s current planning consent. Lendlease has now applied to replace this consent with an entirely new one, to build an office block, not housing.  Southwark is also ready to change the New Southwark Plan (NSP) to pave Lendlease’s way to a successful approval of the application. The change will allow an increase in the office floorspace on Elephant Park, from the maximum of 5,000 sqm that Lendlease is presently allowed, to the 49,565 sqm it is proposing in its new planning application. Southwark has said ‘an office development on this plot is broadly supported’ in the ‘Conclusion’ of pre-application discussions with Lendlease.Late changes to the New Southwark PlanThe change to the NSP, which governs all development throughout the borough, is part of a ‘main modification’ to the Plan. The modification MM7 would allow 60,000 sqm of ‘employment floorspace’ to be built specifically on Elephant Park; at the moment the local plan envisages a maximum of 30,000 sqm of ‘business floorspace’ for the whole Elephant and Castle Opportunity Area.The NSP, including the main modifications, is in the final stages of approval by government inspectors. Comments on all proposed modifications can be made up to a deadline of 24 September 2021.From open space to office spaceA good part of Plot H1 sits on land that was covenanted for use as open space, in perpetuity, when ownership was devolved to Southwark in 1985, on the abolition of the Greater London Council (GLC). In 2014 Southwark transferred ownership of the Heygate land, including Plot H1, to Lendlease, removing the covenant in the process. Southwark is also ready to change the New Southwark Plan (NSP) to pave Lendlease’s way to a successful approval of the application. The change will allow an increase in the office floorspace on Elephant Park, from the maximum of 5,000 sqm that Lendlease is presently allowed, to the 49,565 sqm it is proposing in its new planning application. Southwark has said ‘an office development on this plot is broadly supported’ in the ‘Conclusion’ of pre-application discussions with Lendlease.Late changes to the New Southwark PlanThe change to the NSP, which governs all development throughout the borough, is part of a ‘main modification’ to the Plan. The modification MM7 would allow 60,000 sqm of ‘employment floorspace’ to be built specifically on Elephant Park; at the moment the local plan envisages a maximum of 30,000 sqm of ‘business floorspace’ for the whole Elephant and Castle Opportunity Area.The NSP, including the main modifications, is in the final stages of approval by government inspectors. Comments on all proposed modifications can be made up to a deadline of 24 September 2021.From open space to office spaceA good part of Plot H1 sits on land that was covenanted for use as open space, in perpetuity, when ownership was devolved to Southwark in 1985, on the abolition of the Greater London Council (GLC). In 2014 Southwark transferred ownership of the Heygate land, including Plot H1, to Lendlease, removing the covenant in the process. In 2019 Lendlease took advantage of a poorly drafted s106 legal agreement with Southwark to increase the maximum number of homes allowed on Elephant Park by 220 units, to 2,689. Lendlease is using ten plots of land for these homes, instead of the eleven available, leaving itself a spare plot. This is the justification for the new planning application – Lendlease claims that they have fulfilled their housing obligations under the current planning consent, so Plot H1 can be used for an office development, which would create jobs.Lendlease does not say in their new planning application how many homes could be built on Plot H1, if it were used for housing as originally intended, but by making a rough comparison with neighbouring plot H7, a capacity for about 340 homes can be calculated.Lendlease on manoeuvresLendlease’s Plot H1 planning application is the latest of a succession of self-advantageous manoeuvres. As well as increasing the number of homes on the estate and squeezing them into fewer plots, Lendlease has also announced that over 900 of the free-market homes would no longer be for sale, but kept under their ownership, and let to private renters, not sold. Before this, they marketed and sold substantial numbers of homes overseas . This all followed the notorious 2010 Heygate regeneration agreement, which reduced the affordable housing to 25%, from 35%, with a meagre 79 social rented units (later inching up to 100 units).Southwark Council is now poised to give up a prime housing site (in the middle of an opportunity area, on former council estate land) at Lendlease’s behest. Southwark is doing this while embroiled in controversies across the borough about infill development on council estate sites, none of which are anywhere near the size of the plot it is about to give up. In 2019 Lendlease took advantage of a poorly drafted s106 legal agreement with Southwark to increase the maximum number of homes allowed on Elephant Park by 220 units, to 2,689. Lendlease is using ten plots of land for these homes, instead of the eleven available, leaving itself a spare plot. This is the justification for the new planning application – Lendlease claims that they have fulfilled their housing obligations under the current planning consent, so Plot H1 can be used for an office development, which would create jobs.Lendlease does not say in their new planning application how many homes could be built on Plot H1, if it were used for housing as originally intended, but by making a rough comparison with neighbouring plot H7, a capacity for about 340 homes can be calculated.Lendlease on manoeuvresLendlease’s Plot H1 planning application is the latest of a succession of self-advantageous manoeuvres. As well as increasing the number of homes on the estate and squeezing them into fewer plots, Lendlease has also announced that over 900 of the free-market homes would no longer be for sale, but kept under their ownership, and let to private renters, not sold. Before this, they marketed and sold substantial numbers of homes overseas . This all followed the notorious 2010 Heygate regeneration agreement, which reduced the affordable housing to 25%, from 35%, with a meagre 79 social rented units (later inching up to 100 units).Southwark Council is now poised to give up a prime housing site (in the middle of an opportunity area, on former council estate land) at Lendlease’s behest. Southwark is doing this while embroiled in controversies across the borough about infill development on council estate sites, none of which are anywhere near the size of the plot it is about to give up. Object!Lendlease’s argument that offices will good for employment is entirely self-serving. They did not make this proposal for Plot H1 in 2012, when applying for their first planning permission. Instead, they have tricked their way into a position where they have built more homes than originally consented, on a smaller space, and now want to squeeze in an extra office block for good measure.Southwark Council have aided Lendlease’s application by proposing a ten-fold increase in ‘employment space’ on Elephant Park, in the New Southwark Plan – a huge uplift, introduced to boost the chances of an office-space application being approved.There has been much speculation about whether Southwark’s recent change of leadership has resulted in a change of direction for the Council.This is the planning committee’s chance to prove that the Council won’t roll over to Lendlease indefinitely. The committee must stop this cynical attempt to manipulate planning policy to Lendlease’s advantage and reject this planning application.Once this is done, Southwark should start a sensible discussion on what is to be done with this prime site, with the focus on the local community’s real needs, including affordable housing, with all the amenities and open surroundings needed to make life liveable in London.470 comments and objections have been made to this application.If you would like to add your objection, you can do so here.You can use this model objection text or view our full letter of objection here. Object!Lendlease’s argument that offices will good for employment is entirely self-serving. They did not make this proposal for Plot H1 in 2012, when applying for their first planning permission. Instead, they have tricked their way into a position where they have built more homes than originally consented, on a smaller space, and now want to squeeze in an extra office block for good measure.Southwark Council have aided Lendlease’s application by proposing a ten-fold increase in ‘employment space’ on Elephant Park, in the New Southwark Plan – a huge uplift, introduced to boost the chances of an office-space application being approved.There has been much speculation about whether Southwark’s recent change of leadership has resulted in a change of direction for the Council.This is the planning committee’s chance to prove that the Council won’t roll over to Lendlease indefinitely. The committee must stop this cynical attempt to manipulate planning policy to Lendlease’s advantage and reject this planning application.Once this is done, Southwark should start a sensible discussion on what is to be done with this prime site, with the focus on the local community’s real needs, including affordable housing, with all the amenities and open surroundings needed to make life liveable in London.470 comments and objections have been made to this application.If you would like to add your objection, you can do so here.You can use this model objection text or view our full letter of objection here.Read in browser » Recent Articles:Former Council leader glides through revolving doors Legal battle for the Elephant and Castle shopping centre ends Southwark rips up Aylesbury Area Action Plan Action on Southwark’s empty homes |

| follow on Twitter | friend on Facebook | forward to a friend 35% Campaign |

35% Campaign update – Southwark rips up Aylesbury Area Action Plan

|

|||||||||||||||

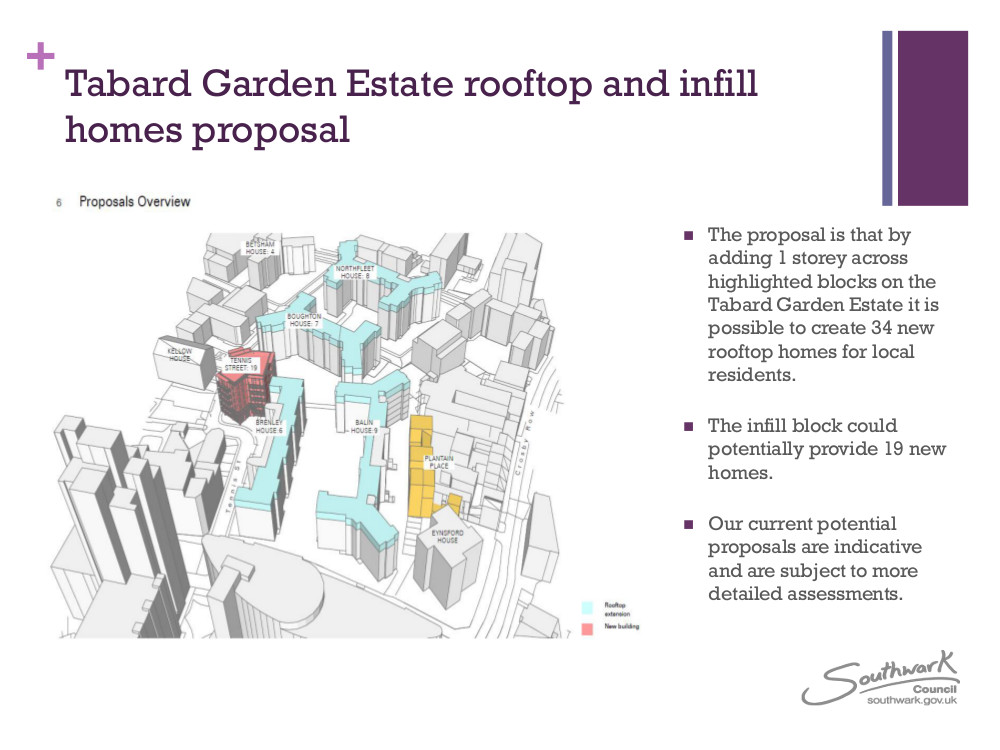

Tabard Gardens North rooftop extensions – update March 2021

Southwark Council has updated the rooftop extensions programme first mentioned in May 2020, increasing the number of blocks affected from 3 (Betsham, Boughton, Brenley) to 5 (adding Balin and Northfleet), plus a new ‘infill’ block on Tennis Street.

A newsletter to inform residents of these changes has gone out this week , available here:

35% Campaign update – Social Rent or Affordable Rent?

|

|||||||||||||||||

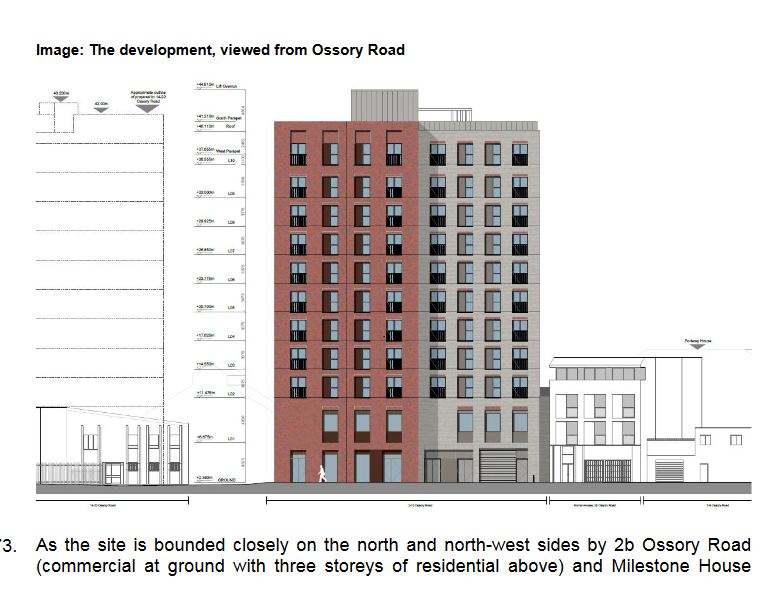

35% Campaign update – No room for social rent at Pocket Living on the Old Kent Road

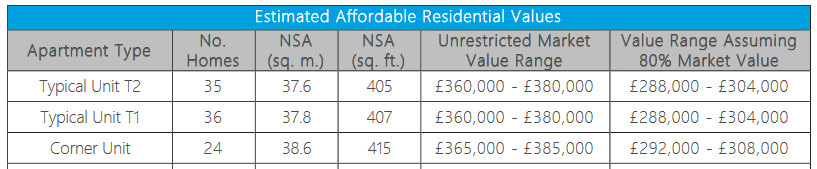

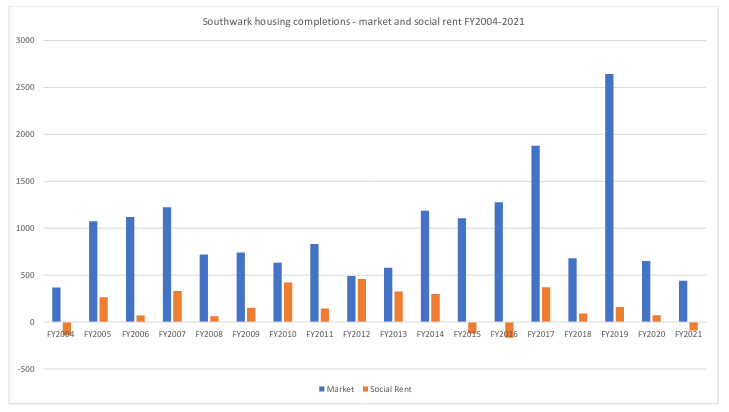

| No room for social rent at Pocket Living on the Old Kent Road Oct 06, 2020 12:00 am 100% affordable housing, zero social rent, zero family housing -Southwark Council is set to approve a mixed-used residential scheme in the Old Kent Rd Opportunity Area with no social rented housing or family housing, at its planning committee meeting this evening.  The proposed development on Ossory Rd is for 105 units of housing, with light industrial space beneath this. All 105 units will be affordable housing, but of the most expensive type, sold at 80% market value. The applicant is Pocket Living, which specialises in maximising the amount of housing on small sites. All the homes will be one-bed, one person units, without family housing. This is the second such Pocket Living development in the area; the first, in Varcoe Rd had 57 units and a third, Credon House, also for 57 units is in the pipeline. The proposed development on Ossory Rd is for 105 units of housing, with light industrial space beneath this. All 105 units will be affordable housing, but of the most expensive type, sold at 80% market value. The applicant is Pocket Living, which specialises in maximising the amount of housing on small sites. All the homes will be one-bed, one person units, without family housing. This is the second such Pocket Living development in the area; the first, in Varcoe Rd had 57 units and a third, Credon House, also for 57 units is in the pipeline. Pocket Living make up their own rulesSouthwark Council requires 35% affordable housing, 70% of which should be social rented, on all developments of this size. This has been the case since 2007 and the requirement has been retained in a succession of local planning documents, up to the draft New Southwark Plan and the Old Kent Rd Area Action Plan. All major approved developments within the Old Kent Rd have pledged to deliver that amount.There should also be at least 20% family housing of 3, 4, 5-beds in major developments and 60% of should comprise 2-bed homes1.Pocket Living, however, want to make up their own rules. Their sites are small and it wishes to maximise the number of homes built, so they are all one -bed/one person units, though 10% of their occupants appear to be couples, with most units barely above the minimum size allowed (37 sq metres) 2.The amount of open and amenity space for occupants is also squeezed. In a development of this size there should be 1,050 sqm private amenity space, Pocket are providing a miniscule 42 sqm. Developers can compensate for a lack of private space with more communal space, but Pocket falls well short here, too, providing less than half the amount required (506 sqm instead of 1,058 sqm) 3 .Not that affordablePocket Living justify their radical departures from Southwark’s affordable housing requirements, by claiming they are serving the hard-pressed, young first-time buyer and supply their own statistics and census figures to back this up, dutifully reproduced by the officer’s report, which recommends approval of the scheme 4. The report also makes the confusing claim that the affordable housing offer is policy compliant: Pocket Living make up their own rulesSouthwark Council requires 35% affordable housing, 70% of which should be social rented, on all developments of this size. This has been the case since 2007 and the requirement has been retained in a succession of local planning documents, up to the draft New Southwark Plan and the Old Kent Rd Area Action Plan. All major approved developments within the Old Kent Rd have pledged to deliver that amount.There should also be at least 20% family housing of 3, 4, 5-beds in major developments and 60% of should comprise 2-bed homes1.Pocket Living, however, want to make up their own rules. Their sites are small and it wishes to maximise the number of homes built, so they are all one -bed/one person units, though 10% of their occupants appear to be couples, with most units barely above the minimum size allowed (37 sq metres) 2.The amount of open and amenity space for occupants is also squeezed. In a development of this size there should be 1,050 sqm private amenity space, Pocket are providing a miniscule 42 sqm. Developers can compensate for a lack of private space with more communal space, but Pocket falls well short here, too, providing less than half the amount required (506 sqm instead of 1,058 sqm) 3 .Not that affordablePocket Living justify their radical departures from Southwark’s affordable housing requirements, by claiming they are serving the hard-pressed, young first-time buyer and supply their own statistics and census figures to back this up, dutifully reproduced by the officer’s report, which recommends approval of the scheme 4. The report also makes the confusing claim that the affordable housing offer is policy compliant: Buying a decent home in London is undoubtedly hard for the young professionals Pocket Living housing is squarely aimed at, but they are still relatively much better off than those excluded by the absence of social and family housing from Pocket Living developments. Pocket’s typical purchaser will have an average income of £44,000 (OR, Para 60), an income enjoyed by less than 4.5% of Southwark’s households. Pocket Living estimates that its homes will sell for approximately £300k each (with the 20% discount). Supplying homes at these prices to those who earn £44k per year, at the expense of those who earn barely half that is not what affordable housing should be about5. Buying a decent home in London is undoubtedly hard for the young professionals Pocket Living housing is squarely aimed at, but they are still relatively much better off than those excluded by the absence of social and family housing from Pocket Living developments. Pocket’s typical purchaser will have an average income of £44,000 (OR, Para 60), an income enjoyed by less than 4.5% of Southwark’s households. Pocket Living estimates that its homes will sell for approximately £300k each (with the 20% discount). Supplying homes at these prices to those who earn £44k per year, at the expense of those who earn barely half that is not what affordable housing should be about5. Density and un-exemplary designUnsurprisingly, given Pocket’s ambitions to maximise the number of units, they are proposing a scheme which is twice the density it should be, (at 2,333 habitable rooms per hectare against a maximum allowed of 1,100 hrph), justified on the basis of exemplary design. However, many of the measures for ‘exemplary’ design are not met – it does not have enough amenity space, there is no ‘predominance’ of dual aspect flats, it does not have any 2-bed or more flats, and the flats do not ‘significantly exceed minimum floor-space standards’ 6.Equality not a great considerationThe lack of social and family housing and the provision of all the homes as single bed units, targeted at middle income professionals, would also seem to have clear implications for the various social groups protected under equalities legislation. Southwark have a legal duty to consider this, but have not done so in any detail, content just to note of affordable housing, that there is ‘a high demand for such accommodation and a relatively high BAME population’ 7.Viability and the Bakerloo Line ExtensionThe officer’s report and recommendation for approval was written before press-reports that the Bakerloo Line extension has fallen down the list of priorities for Transport for London (TfL) and may not be built for many years. Pocket Living’s proposal is, according to themselves, technically non-viable and depends upon the delivery of the BLE to turn a profit (as do many other Old Kent Rd schemes) 8. There is no mention of a late stage review of the scheme’s viability, which removes the possibility of any improvement in the affordable housing offer, such as a greater discount in the selling price.The Mayor likes itWhile Pocket Living pretty much ignores Southwark’s own housing policy, so does the officer’s report to the planning committee, which notes the departures, but nonetheless recommends approval on other ‘material’ grounds. The report also cites the enthusiastic support of the Mayor (matching his enthusiasm for Build to Rent, another middle/upper income affordable housing tenure that sacrifices social rent)9.What we say…It is hard to see what this scheme brings to the Old Kent Rd, in housing terms. It has no social housing and no family housing. The affordable housing it does provide is of the most expensive kind. The scheme does not have the private and public space that it should have and it serves a very narrow demographic, while excluding broader sections of the community.Pocket Living would argue that the constraints of the site and the housing needs of a relatively well-off section of the community should outweigh these shortcomings, but Southwark’s local plan already addresses how much housing there should be for different income groups, with the overarching aim of building a mixed and cohesive community. Pocket Living simply ignores this, so the planning committee should reject this application.You can find the 35% Campaign objection to this development here. Footnotes:Southwark’s Core Strategy Strategic Policy 7 – Family homes, pg 86 ↩Officer Report Table pg 42 ↩Officer Report para 133,134,135 ↩Officer Report para 112 ↩New Southwark Plan Submission Version Jan 2020 Fig 2 ↩Officer Report para 118, 119 ↩Officer Report para 28 ↩Officer Report para 64, 65 ↩Officer Report para 229-237; 57 ↩ Density and un-exemplary designUnsurprisingly, given Pocket’s ambitions to maximise the number of units, they are proposing a scheme which is twice the density it should be, (at 2,333 habitable rooms per hectare against a maximum allowed of 1,100 hrph), justified on the basis of exemplary design. However, many of the measures for ‘exemplary’ design are not met – it does not have enough amenity space, there is no ‘predominance’ of dual aspect flats, it does not have any 2-bed or more flats, and the flats do not ‘significantly exceed minimum floor-space standards’ 6.Equality not a great considerationThe lack of social and family housing and the provision of all the homes as single bed units, targeted at middle income professionals, would also seem to have clear implications for the various social groups protected under equalities legislation. Southwark have a legal duty to consider this, but have not done so in any detail, content just to note of affordable housing, that there is ‘a high demand for such accommodation and a relatively high BAME population’ 7.Viability and the Bakerloo Line ExtensionThe officer’s report and recommendation for approval was written before press-reports that the Bakerloo Line extension has fallen down the list of priorities for Transport for London (TfL) and may not be built for many years. Pocket Living’s proposal is, according to themselves, technically non-viable and depends upon the delivery of the BLE to turn a profit (as do many other Old Kent Rd schemes) 8. There is no mention of a late stage review of the scheme’s viability, which removes the possibility of any improvement in the affordable housing offer, such as a greater discount in the selling price.The Mayor likes itWhile Pocket Living pretty much ignores Southwark’s own housing policy, so does the officer’s report to the planning committee, which notes the departures, but nonetheless recommends approval on other ‘material’ grounds. The report also cites the enthusiastic support of the Mayor (matching his enthusiasm for Build to Rent, another middle/upper income affordable housing tenure that sacrifices social rent)9.What we say…It is hard to see what this scheme brings to the Old Kent Rd, in housing terms. It has no social housing and no family housing. The affordable housing it does provide is of the most expensive kind. The scheme does not have the private and public space that it should have and it serves a very narrow demographic, while excluding broader sections of the community.Pocket Living would argue that the constraints of the site and the housing needs of a relatively well-off section of the community should outweigh these shortcomings, but Southwark’s local plan already addresses how much housing there should be for different income groups, with the overarching aim of building a mixed and cohesive community. Pocket Living simply ignores this, so the planning committee should reject this application.You can find the 35% Campaign objection to this development here. Footnotes:Southwark’s Core Strategy Strategic Policy 7 – Family homes, pg 86 ↩Officer Report Table pg 42 ↩Officer Report para 133,134,135 ↩Officer Report para 112 ↩New Southwark Plan Submission Version Jan 2020 Fig 2 ↩Officer Report para 118, 119 ↩Officer Report para 28 ↩Officer Report para 64, 65 ↩Officer Report para 229-237; 57 ↩Read in browser » Shopping Centre closes, but campaign for traders continuesSep 28, 2020 12:00 am Protesters mark the final day for Elephant shopping centre -The closure of the Elephant and Castle shopping centre last Thursday was marked by protest, impassioned speeches and widespread media coverage. The centre closed after 55 years’ service to the local community and is now set to be demolished, to make way for a new retail, leisure and residential complex. Shopping centre owner, Delancey, leads the development partnership behind the new scheme.  While the centre’s major stores had gradually left over the previous months, many of the independent businesses were trading up to the final day. The closure also brought the end for the market which occupied the centre’s ‘moat’, which numbered around 60 stalls just under 2 years ago when Southwark’s planning committee first considered developer Delancey’s proposals for the centre’s redevelopment.Only 40 traders have been relocated to three sites – Castle Square, Perronet House and Elephant Park – ‘leaving about 40 traders who have been trading at least since January 2019 (as per the s106 agreement) without alternative premises’. A major aim now of the traders and their supporters is to secure space that could double the number of relocated traders, with a proposal to the Mayor for new market stalls at the Elephant.Up the Elephant solidarityA large protest organised by the Up the Elephant campaign (which includes the 35% Campaign) marked the centre’s closure and commemorated the people who had worked there, many from for black and ethnic minorities, and its role as a social hub for the Latin American community in particular. The campaign has long fought against the demolition and Delancey’s redevelopment plans and while the centre’s fate was lamented, speakers also noted the gains that the campaign had made – more social housing, affordable retail space as well as new premises for some displaced traders, along with transition and relocation funding. While the centre’s major stores had gradually left over the previous months, many of the independent businesses were trading up to the final day. The closure also brought the end for the market which occupied the centre’s ‘moat’, which numbered around 60 stalls just under 2 years ago when Southwark’s planning committee first considered developer Delancey’s proposals for the centre’s redevelopment.Only 40 traders have been relocated to three sites – Castle Square, Perronet House and Elephant Park – ‘leaving about 40 traders who have been trading at least since January 2019 (as per the s106 agreement) without alternative premises’. A major aim now of the traders and their supporters is to secure space that could double the number of relocated traders, with a proposal to the Mayor for new market stalls at the Elephant.Up the Elephant solidarityA large protest organised by the Up the Elephant campaign (which includes the 35% Campaign) marked the centre’s closure and commemorated the people who had worked there, many from for black and ethnic minorities, and its role as a social hub for the Latin American community in particular. The campaign has long fought against the demolition and Delancey’s redevelopment plans and while the centre’s fate was lamented, speakers also noted the gains that the campaign had made – more social housing, affordable retail space as well as new premises for some displaced traders, along with transition and relocation funding. What the Papers say…There was extensive press and media coverage of the closure and protest, including articles on the SE1 website, Southwark News, South London Press, South West Londoner, Morning Star, The Guardian (and here), the Justice Gap, Vice and the Spanish language Express News UK (and here) and the BBC’s Drivetime with Eddie Nestor. What the Papers say…There was extensive press and media coverage of the closure and protest, including articles on the SE1 website, Southwark News, South London Press, South West Londoner, Morning Star, The Guardian (and here), the Justice Gap, Vice and the Spanish language Express News UK (and here) and the BBC’s Drivetime with Eddie Nestor. Amongst the comments from protest speakers highlighted in SE1 website were those from Patria Roman of Latin Elephant, a mainstay of the campaign, and trader Emad Megahed.Patria expressed her sadness at the closure of the shopping centre but noted that campaigning efforts had yielded improvements in the support provided by developers and the council to local traders.‘I am incredibly proud of all we achieved,’ she said.‘If today we can say that some traders have been relocated, it is because the campaigners fought fiercely. Everything they have is because campaigners fought for it. Nothing came for free.’Emad said – ‘I am so proud of my community. I am proud that my community stuck together – whatever nationality … we all speak the same language, the language of love, and sticking together as one. That’s the lesson we want to teach our kids.’The Guardian noted ‘the shadow of decades of underinvestment’and commented-‘rarely has a managed decline been so obvious, or so long-winded’adding-‘you don’t need to love the shopping centre as it is right now (or at all), or worry about what happens after its demolition to the meeting places, public spaces and social bonds it offers, …. to raise questions about who must leave and who can stay, when the developers arrive in town’. Amongst the comments from protest speakers highlighted in SE1 website were those from Patria Roman of Latin Elephant, a mainstay of the campaign, and trader Emad Megahed.Patria expressed her sadness at the closure of the shopping centre but noted that campaigning efforts had yielded improvements in the support provided by developers and the council to local traders.‘I am incredibly proud of all we achieved,’ she said.‘If today we can say that some traders have been relocated, it is because the campaigners fought fiercely. Everything they have is because campaigners fought for it. Nothing came for free.’Emad said – ‘I am so proud of my community. I am proud that my community stuck together – whatever nationality … we all speak the same language, the language of love, and sticking together as one. That’s the lesson we want to teach our kids.’The Guardian noted ‘the shadow of decades of underinvestment’and commented-‘rarely has a managed decline been so obvious, or so long-winded’adding-‘you don’t need to love the shopping centre as it is right now (or at all), or worry about what happens after its demolition to the meeting places, public spaces and social bonds it offers, …. to raise questions about who must leave and who can stay, when the developers arrive in town’. Southwark News also covers the rebuttal of Southwark Council and Delancey claims that nearly all traders have been satisfactorily relocated. It quotes Latin Elephant, which has profiled those turned down for new premises or unable to find appropriate space, and who say-‘Our research has been widely documented, and it was carried out independently with an effort to enforce transparency and accountability. This has been discussed several times with Southwark Council and Delancey. It is unacceptable to see the closure of the Shopping Centre with many traders still without relocation, so we will continue our advocacy work in a constructive way to support the local community.’The Mayor responds to traders’ proposalA day before the centre’s closure Mayor Sadiq Khan responded to the traders’ proposal for new market stalls to accommodate traders who have not been allocated new premises.Southwark News and The South London Press highlighted the response. The Mayor, quoted in the SLP, says ‘It is disappointing that a number of small businesses still don’t have the certainty they need….in general I would welcome any workable solution that would provide these businesses with the space they need to trade’ while cautioning that the traders’ proposal ‘would be subject to various planning and licensing consents’ making it ‘not appropriate’ to comment on the specific plans being presented.The traders’ proposal is supported by Florence Eshalomi MP, London Assembly member for Lambeth and Southwark, local councillor Maria Linforth-Hall and London Assembly members Caroline Pidgeon and Sian Berry, the Green Party candidate for Mayor. The Camberwell and Peckham Labour Party Constituency Party also passed a motion in support of the traders’ Proposal at their meeting last week.The traders and their supporters will now be building on this support to get new market stalls and kiosks for those traders without new premises and repair some of the damage done to their businesses and livelihoods, by the centre closure. Southwark News also covers the rebuttal of Southwark Council and Delancey claims that nearly all traders have been satisfactorily relocated. It quotes Latin Elephant, which has profiled those turned down for new premises or unable to find appropriate space, and who say-‘Our research has been widely documented, and it was carried out independently with an effort to enforce transparency and accountability. This has been discussed several times with Southwark Council and Delancey. It is unacceptable to see the closure of the Shopping Centre with many traders still without relocation, so we will continue our advocacy work in a constructive way to support the local community.’The Mayor responds to traders’ proposalA day before the centre’s closure Mayor Sadiq Khan responded to the traders’ proposal for new market stalls to accommodate traders who have not been allocated new premises.Southwark News and The South London Press highlighted the response. The Mayor, quoted in the SLP, says ‘It is disappointing that a number of small businesses still don’t have the certainty they need….in general I would welcome any workable solution that would provide these businesses with the space they need to trade’ while cautioning that the traders’ proposal ‘would be subject to various planning and licensing consents’ making it ‘not appropriate’ to comment on the specific plans being presented.The traders’ proposal is supported by Florence Eshalomi MP, London Assembly member for Lambeth and Southwark, local councillor Maria Linforth-Hall and London Assembly members Caroline Pidgeon and Sian Berry, the Green Party candidate for Mayor. The Camberwell and Peckham Labour Party Constituency Party also passed a motion in support of the traders’ Proposal at their meeting last week.The traders and their supporters will now be building on this support to get new market stalls and kiosks for those traders without new premises and repair some of the damage done to their businesses and livelihoods, by the centre closure.Read in browser » Recent Articles:The Elephant traders who face the end without new homes Shopping Centre traders propose new stalls for the Elephant Southwark responds to shopping centre campaignersfollow on Twitter | friend on Facebook | forward to a friend 35% Campaign |

35% Campaign update – The shopping centre traders expelled by regeneration

|

New Housing Strategy – Consultation

Dear TRA Chair,

Over the past year the council has been consulting on a new housing strategy. This has included a stakeholder session back in June 2019, and a public consultation between January and May this year.

We were in the process of consulting on the housing strategy when the COVID-19 pandemic started to seriously impact on the United Kingdom in March 2020 therefore the consultation period was extended to May.

Many thanks for all the comments received so far.

The housing strategy is a long term document covering the next thirty years but the COVID-19 pandemic is likely to have a significant impact on the delivery of the strategy in the short term to medium term, and there may also be longer term consequences.

The pandemic has impacted on every principle of the housing strategy. We have have added new text throughout the strategy.

We have also made changes to the strategy in response to comments made so far during the earlier consultation, such as adding more text about tacking climate change.

All changes since the past consultation draft are included in purple text.

As there has been considerable change since the original consultation we have decided to do another quick final round of consultation.

We want to give partners and other key stakeholders an opportunity to comment on the proposed changes, and to highlight any other changes you think are required to respond to the new challenges with the pandemic.

Please email any comments you have to housingstrategy2@southwark.gov.uk by the end of August 2020.

We look forward to hearing your views.

Many thanks,

Rob

Robert Weallans, Housing Strategy Manager

Housing Strategy and Business Support, Resident Services Division, Housing & Modernisation Department

( 020 752 51217 | : robert.weallans@southwark.gov.uk | Tooley Street, 5th floor, Hub 3

Copies of the housing strategy are available at www.southwark.gov.uk/housing/housing-strategy

Visiting address: Southwark Council, 160 Tooley Street, London, SE1 2QH

Postal address: Southwark Council, P O Box 64529, London SE1P 5LX

www.southwark.gov.uk/mysouthwark For council services at your fingertips, register online. You can also manage your rent or service charge account, pay your council tax as well as report and track your housing repairs.

Planning Application 20/AP/1159, deadline extension to 14th September

Comment on this application here.

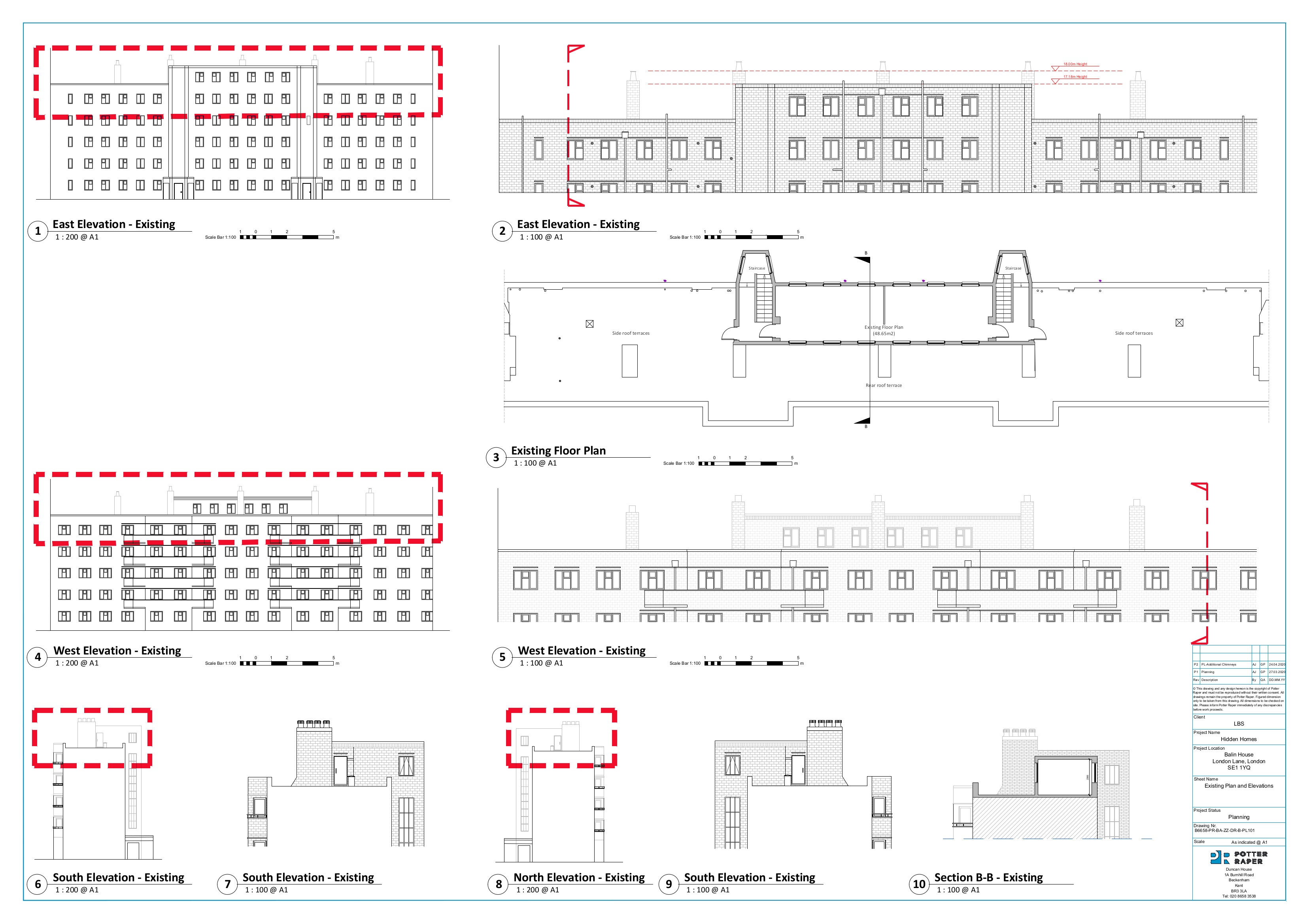

Construction of 4 new flats at Balin House

Planning Application 20/AP/1159

20_AP_1159-APPLICATION_FORM_-_WITHOUT_PERSONAL_DATA-867293

20_AP_1159-DESIGN___ACCESS_STATEMENT-867289

20_AP_1159-SITE_LOCATION__EXISTING___PROPOSED_BIN___CYCLE_STORAGE-867287

20_AP_1159-EXISTING___PROPOSED_ROOF_PLAN-868970

PROPOSED_PLANS__SECTION___ELEVATIONS-868969

Lights out on the redeveloped Heygate estate.

Lights out on the redeveloped Heygate estate.

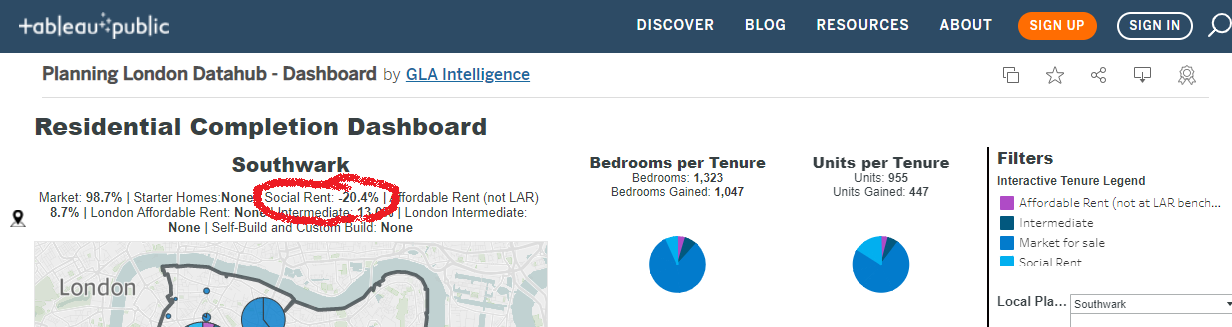

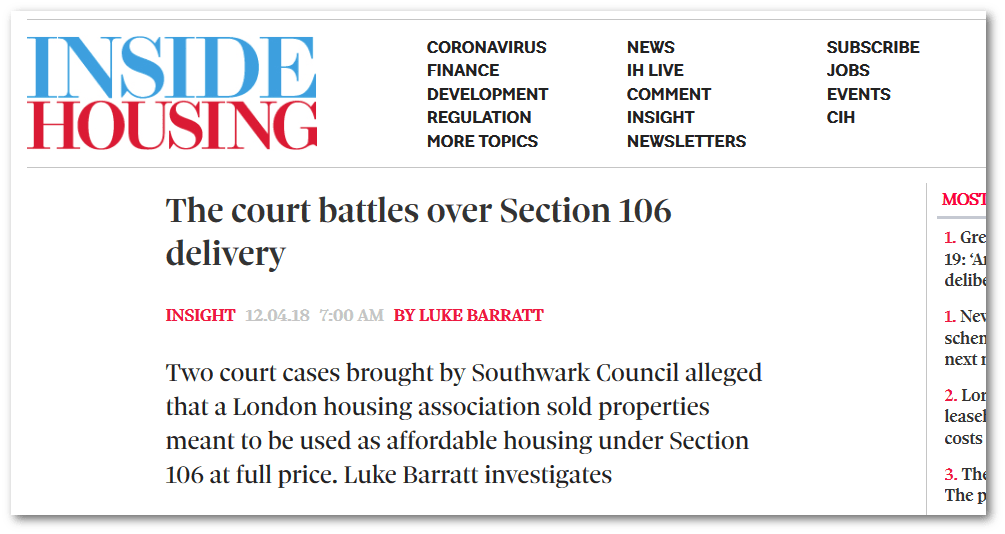

Guardian article including our findings at the Neo-Bankside development

Guardian article including our findings at the Neo-Bankside development The Signal Building at Elephant & Castle where affordable homes were let at market rent and then sold on the open market

The Signal Building at Elephant & Castle where affordable homes were let at market rent and then sold on the open market

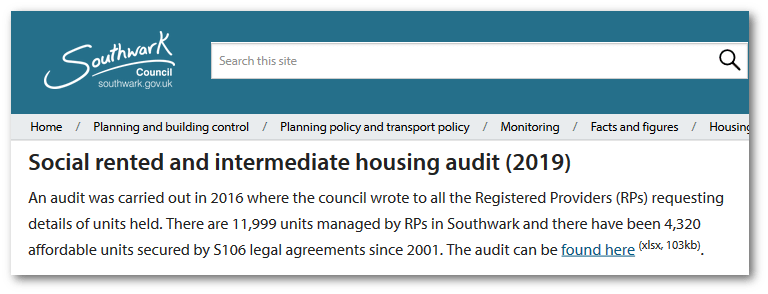

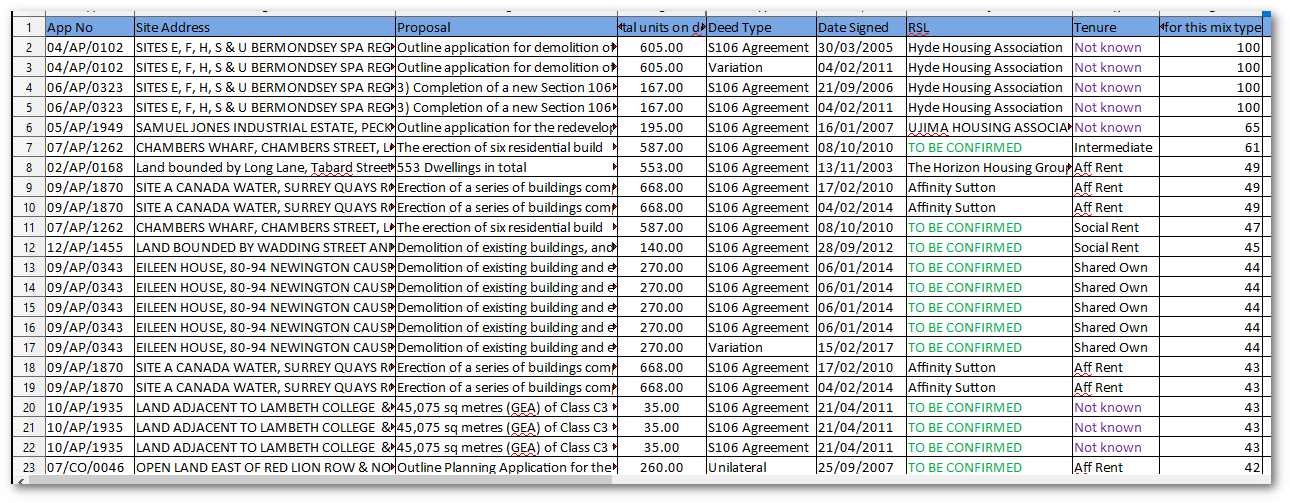

Extract from the Council’s

Extract from the Council’s

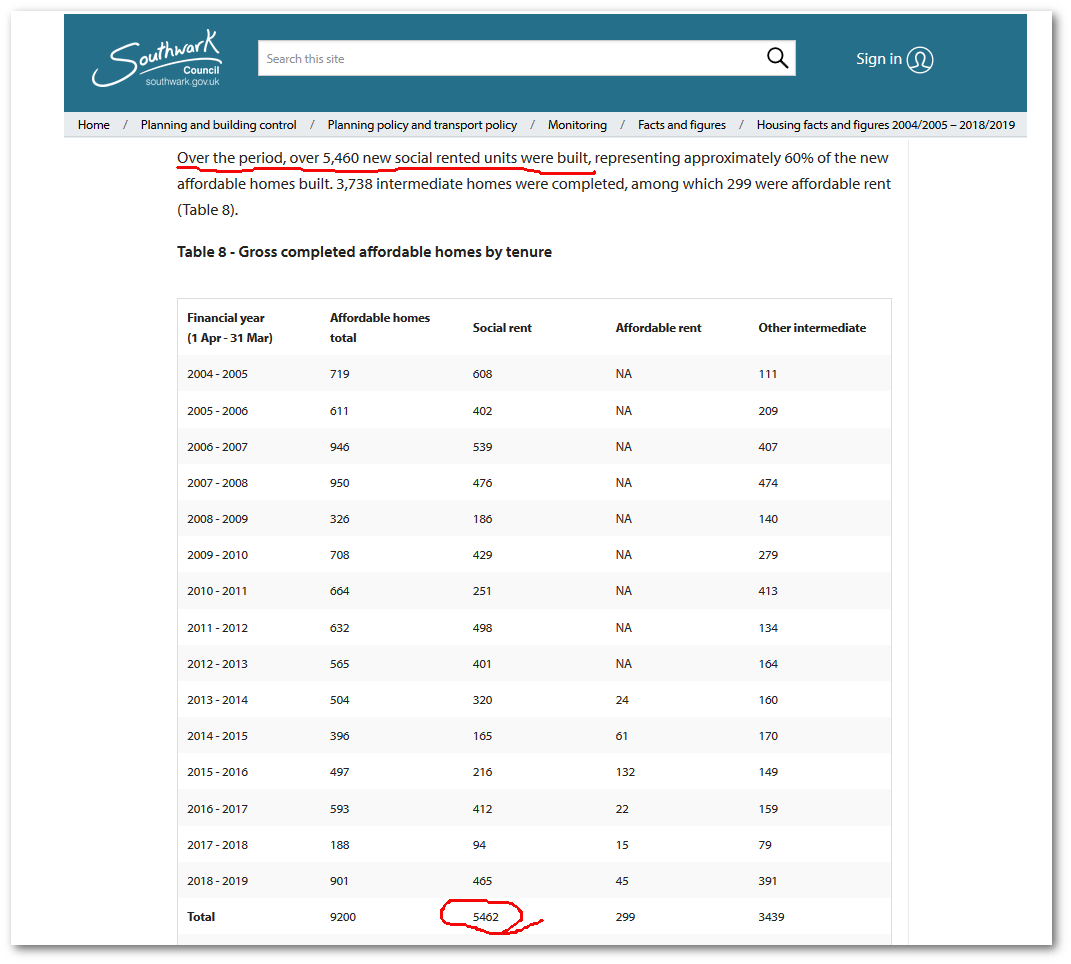

Southwark’s website

Southwark’s website