|

||||||||||||||||||

Neighbourhood Development

Support Camberwell residents fight against developer

Dear Friend

Southwark Council recently refused planning permission to a large development just off the Old Kent Rd, by Burgess Park, after a campaign by local residents, who objected to its size and impact on the park.

Now the developer is appealing against that decision and there will be a hearing before a government Inspector in August. Local residents have started a CrowdJustice appeal to get legal representation at the hearing and make sure that their voice is heard. The appeal is supported by Southwark Law Centre, Wells Way TRA, Friends of Burgess Park, Vital OKR and the Camberwell Society.

The development, known as Camberwell Union, offers 35% affordable housing, but should be offering 50%, because it would be on industrial land. Mayor Sadiq Khan has promised 50% affordable housing on such sites in his new London Plan.

Please support the Camberwell residents in their fight by donating and sharing their CrowdJustice link.

Regards

Jerry

Copyright © 2019 Elephant Amenity Network, All rights reserved.

35% Campaign update – Malt Street – the next big Old Kent Road development

Malt Street – the next big Old Kent Road development

Jun 01, 2019 12:00 am

Big questions for Berkeley Homes still unanswered –

Southwark’s planning committee is to consider yet another major Old Kent Rd development on Monday, the fourth so far, after Ruby Triangle, Cantium Retail park and Southernwood Retail Park. Southernwood was unanimously approved by Southwark’s planning committee just last week, despite objections, including doubts about whether it that it will deliver the maximum reaonable amount of affordable housing. Serious concerns raised about the impact of the scheme on the proposed Bakerloo Line Extension (BLE), were allayed by a last minute letter to the Council from Transport for London (TfL).

For Malt St, Berkeley Homes proposes a mixed use development, including 1,300 homes and 7,000 sqm of commercial space, on 1.9 hectares of land behind Asda. It is a ‘hybrid’ application of two parts, a detailed application for 420 homes, and an outline application for 880 homes. The total development comprises 11 blocks, including 39 and 44 storey towers, to be built in three phases, with completion by 2027.

Berkeley Homes are offering 40% affordable housing in total across the whole scheme, with the detailed part of the scheme providing 83 social rented and 48 intermediate units, but leaving the exact number of affordable units provided by the outline part of the scheme to be determined later.

Taking the ‘social’ out of social rent?

As stated in the planning committee report, Berkeley propose 35% affordable housing, of which 25% would be social rent, 10% intermediate, with an additional 5% intermediate, supplied with the help of grant funding. However, the term ‘social rent’ does not appear anywhere throughout Berkeley’s planning application, with the documents eg the viability assessment, using the term ‘affordable rented’ or just ‘rent’ instead.

Even the Mayor’s Stage 1 planning report avoids using the term ‘social rent’ and instead describes the proposed tenure as ‘low-cost rent’ (para 33) . This is yet another affordable housing label, newly introduced by the Mayor’s draft New London Plan, where it is defined to include London Affordable Rent, as well as social rent. The London Tenant’s Federationhas given evidence to the Mayor that there is a 43% difference between LAR and social rent, while the GLA has conceded during the Plan’s public examination that there is a 14% difference between new build LAR and social rent.

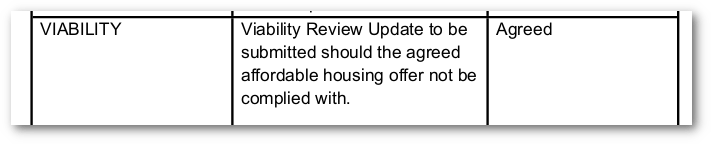

The Malt St S106 draft heads of terms document says that the exact tenure of the affordable housing will not be decided until after the application is approved:

We have seen before promises of social rent do no not necessarily guarantee that social rent will be delivered and we are still waiting for the promised audit of affordable and social rented housing, after a damning ombudsman investigation, which found that Southwark had not monitored or enforced the tenure requirements of its s106 affordable housing agreements.

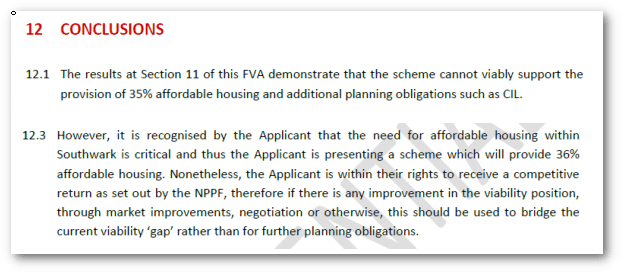

No late stage review

Berkeley Homes’ viability assessment of the Malt St scheme says it will produce a ‘substandard return’ and it is technically unviable with 35% affordable housing (just as the developers of Ruby Triangle, Cantium Retail Park and Southernwood Retail did).

Southwark’s consultant’s agree with this analysis, albeit they calculate that the scheme is slightly less unviable than Berkeley claim. In any event, Berkeley offer 40% affordable housing on the understanding that the viability will be improved by better transport links (ie the Bakerloo Line Extension) and the ongoing regeneraation of the area. There is an important proviso, however – that there will be no late stage review.

This pre-empts any possibility that the amount of affordable housing will be raised to 50%, as required by the draft London Plan for Strategic Industrial land, such as the Malt St site – (the draft London Plan will be fully in force by the time Malt St is completed.)

Applications can avoid a late stage review, if they take the Mayor’s Fast Track Route, by providing, 50% affordable housing, but the Mayor’s planning report makes it clear this is not happening in this case:

“The application does not therefore follow the Fast Track Route with 35% affordable housing (as the threshold level would be 50% in this instance), and it must therefore be considered under the viability tested route.” (paragraph 32)

A 35% Campaign objection on this point is appended to the end of this blogpost.

Viability assessment flaw

An important part of viability assessments is estimating a scheme’s likely revenue. This is done by using ‘comparables’ ie the revenues other similiar schemes have realised. Berkeley Homes commissioned Savills for this task and they estimated an average sales value of completed homes of £776 per square foot.

Extract from the Savills report in Berkeley’s viability assessment (appendix 4a)

Extract from the Savills report in Berkeley’s viability assessment (appendix 4a)

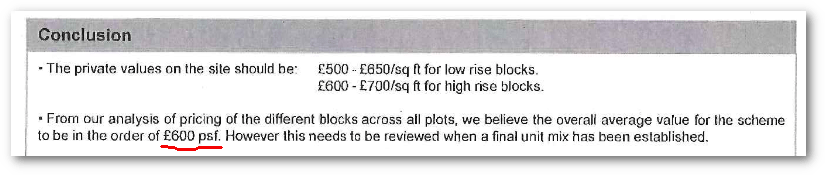

In arriving at this figure Savills uses Elphant Park (formerly the Heygate estate) where the sales are currently achieving £1,247 per sqft.

This is double the revenue estimate of £600 per sq ft Savills gave back in 2012, when it was commissioned for exactly the same task by Elephant Park developer Lendlease.

Extract from the Savills report in Lendlease’s viability assessment for Heygate estate redevelopment

Extract from the Savills report in Lendlease’s viability assessment for Heygate estate redevelopment

The explanation for this big difference lies with the rule that viability assessments are based on current day values. This is a major problem in the viability testing method and is supposed to be mitigated by sensitivity analysis or scenario testing, where various increases in sales values are tested, but these tests are often inadequate. In the Heygate case the District Valuer Service, acting for Southwark, ran just one scenario, with a 5% increase in sales values, when the actual increase has proved to be just over 100%.

In the case of Malt St, Berkeley’s hasn’t done any scenario testing. The Council’s independent review has done some, but only with a 5% increase in sales values. More comprehensive scenario testing should have been undertaken, for a major schemes such as this, likely to take a decade to complete and where values will be affected by such a major variable as the Bakerloo line extension.

In the absence of this the very least the Council should do is secure a late stage review, which should ensure that any great rise in values does not solely benefit the developer’s profit, but is shared with local community, in the form of more affordable housing.

35% Campaign objection to no late stage review

“I am writing on behalf of the 35% Campaign to object to the recommended approval of planning application ref: 17/AP/2773.

The planning committee report for this application refers to the 40% affordable housing offer as exceeding the policy compliant level, stated as 35% (para 167). However, para 22 of the report also notes that the site is ‘designated Strategic Industrial Land (SIL), in the London Plan’; as such, the draft New London Plan requires a higher, 50% level of affordable housing under Policy H6, Para B(3).

The planning committee report gives weight to the draft New London Plan and other emerging policy to justify the release of industrial land for residential and other development (para 145), in the first instance; therefore equal weight should be given to the 50% affordable housing requirement for housing built on such land and 50% affordable housing required.

Without 50% affordable housing the application fails to qualify for the draft London Plan’s Fast Track route under the threshold approach to viability testing. Policy H6 is clear that applications that do not meet the 50% SIL threshold are subject to the viability tested route, which involves a Late Stage Viability review (Para E 2(b)). This is confirmed in the GLA Stage 1 report for the scheme (para 32), which states;

A late stage review should therefore be required if 50% affordable housing is not offered.

For these reasons and in the light of the Stage 1 report, we believe that the planning committee report is wrong when it states that the affordable housing offer ‘exceeds the 35% GLA threshold level’ and ‘re-provides the existing commercial floorspace’ and that therefore there need be no late stage review (para 171). (NB Nothing in Policy H6 says that the 50% threshold for SIL locations can be avoided if existing commercial floorspace is re-provided).

As the application is a large phased development a mid-term review should also be required, according to Policy H6, Para E 2(c).

35% Campaign update – Southernwood Retail Park

Southernwood Retail Park

May 27, 2019 12:00 am

Third of big four Old Kent Rd developments goes to committee

A proposal for the development of Southernwood Retail Park is due to be decided at Southwark’s planning committee this Tuesday evening. Developer Glasgow City Council, acting as trustees for its (Strathclyde) Pension Fund, wants permission for a mixed-use development of 725 residential units, with a hotel, cinema, shops, restaurants and offices. The proposed scheme has seven blocks, including a 48-storey tower. The site is currently occupied by Argos and Sports Direct, just opposite Tesco and over the road from Burgess Park.

Southernwood offers, in round figures, 35% affordable housing; 25% of the total housing will be social rent, 10% intermediate, in line with the emerging New Southwark Plan’sminimum requirements, giving 219 units.

Viability conundrum

Viability assessments have become notorious as a way for developers to avoid their affordable housing obligations. Over the past few years housing campaigners and several high profile cases have managed to shed some light on this practice, leading to changes in policy and greater scrutiny of developer’s viability claims.

In Southwark this had meant we are starting to get the 35% affordable housing that we have been denied until now. But while developers are offering 35% affordable housing, they continue to insist that their schemes are unviable. Southernwood Retail Park is a case in point. Here the developer (Glasgow City Council) claims that they will only make 2.24% (£8.4m) profit on Gross Development Value (GDV); Southwark’s consultants beg to differ and say 16.37% (£62.5m) can be made. Both figures fall short of Glasgow CC’s profit target (set by themselves) of 18.84% (£72m), so the development is technically deemed ‘unviable’.

Glasgow CC’s 18.84% target profit exceeds its benchmark return of 10.4% set by its pension fund manager for real estate projects (DTZ), who manage Southernwood on its behalf (See DTZ, pg 97 in Strathclyde Pension Fund’s most recent annual report).

Despite the Southernwood scheme being deemed ‘unviable’, Glasgow CC says that it will deliver 35% affordable housing, comprising 25% social rent and 10% intermediate, in line with minimum local policy requirements. The Council’s planning report accepts the 35% affordable offer, but without addressing the difference in the profit estimates or considering the difference in the profit target and the pension fund’s DTZ target benchmark.

After so many major developments at the Elephant & Castle and elsewhere in Southwarkhave been allowed to flout affordable housing requirements, this can be counted as progress, but leaves the true viability of the Southernwood scheme unresolved. This is important, because as well as all the minimum affordable housing requirements, there is also a general requirement to produce the maximum reasonable amount of affordable housing, which obviously cannot be known, unless the real viability position is known. There is also the danger that the development proves to be ‘undeliverable’ and the developer returns to get the promised affordable housing reduced.

The Southernwood scheme joins Ruby Triangle and Cantium Retail Park as an ‘unviable’ scheme that will deliver 35% affordable housing. Unlike Ruby Triangle, but like Cantium Retail Park, no ‘late stage review’ of viability is proposed for Southernwood. This is a comprehensive viability review where developers are required to disclose in detail actual costs and revenue received, to establish the scheme’s real profitability and enable the local authority to ‘claw back’ additional affordable housing, should the profit be greater than anticipated. Given the site’s position alongside the likely site of a new tube station should the Bakerloo line extension be built, this looks like a serious omission.

Affordable housing – 35%, 40% or 50%?

Two other features in the Southernwood application stand out – the first is that the applicant, Glasgow City Council, is reluctant to take advantage of any public funding, such as that available from the Mayor of London, which could raise the affordable housing to at least 40%, giving another 30 or so affordable homes. All schemes are expected to consider this, to maximise affordable housing, under the Mayor’s Housing policy. Glasgow CC’s surprising explanation for not applying for public funding is that it claims it will make the scheme less viable. As related in the planning committee report (Para 182,183), this is because the £28,000 per unit grant (for each of the 250 affordable homes) would not make up the full loss in value of converting 5% of the private market homes into affordable homes. It appears, however, that in reaching this conclusion Glasgow CC have used the highest values of the private flats in the 48-storey tower for comparison, rather than the lower-value private flats in the lower blocks, the difference being £600k per unit versus £500k per unit.

Glasgow CC also say that they will not be in time for the current funding round, which requires a start on site before 31st March 2021, notwithstanding that Phase 1 of the scheme would commence in 2021, to be “open and operational by 2022/23” (Para 44); the report simply proposes a condition that this is reconsidered before the scheme is implemented. The second half of the scheme won’t commence until May 2030 and won’t complete until 2033 (See para 57 of planning committee report).

The second feature is that the site is both owned by a local authority and is in an area marked as a Strategic Industrial Location and on both counts should deliver 50% affordable housing, according to the draft New London Plan, which would raise the number of affordable homes to around 360.

Glasgow CC submitted its own legal opinion on this, arguing that the site should not be considered as public land because it would ” penalise the members of the [Pension] Fund simply for having worked as public servants” (see para 173 of planning committee report). There can be no dispute that the land is owned by Glasgow City Council, on behalf of its pension fund, as land Registry deeds show; nonetheless Southwark and the Greater London Authority (GLA) have accepted Glasgow CC’s argument.

Southwark’s and the Mayor’s decision flies in the face of the Mayor’s planning policy, which has its own specific Guidance Note for determining what constitutes public land – Threshold Approach to Affordable Housing on Public Land (July 2018). This defines it as “Land that is owned or in use by a public sector organisation, or company or organisation in public ownership” (para 9). Anticipating disputes on the definition, the note goes on to say that these “will be determined with reference to the Public Sector Classifications Guide (PSCG) published by the Office for National Statistics“ and this guide lists Local Government Pension Funds as a public sector body, just as Glasgow CC is a public sector body.

Notwithstanding this Southwark argues in the legal advice appended to the planning committee report that imposing the higher 50% affordable housing “would reduce the capital value of the site and therefore the Fund’s ability to pay pensions to retired workers”and that “It would be unfair on the retired workers if their pension expectation might possibly be impacted..”

It might well be ‘unfair’ to pensioners if this happened, but it would also be ‘unfair’ to those who need affordable housing if it is not delivered when required by policy. It is also unfair on planning committee members who are recommended to approve this scheme without the detailed policy requirements or the alleged ‘impact’ on pensions having been properly explained in the planning report.

As unedifying as it would be to see two local authorities fight over their respective shares of a development’s profit, one on behalf of pensioners, the other, on behalf of those who need affordable housing, Southwark and the GLA’s responsibility in this situation is to vigorously represent the interests of those in housing need and it has not done so, by giving way so easily.

TfL gives scheme (many) red lights

There also appears to be major issues, to say the least, with Transport for London (TfL), particularly around the impact of the development on plans for the proposed Bakerloo Line Extension (BLE). In its latest communication of barely a month ago, in which TfL urges Southwark not to approve the application, except for “the rear portion of the site”, until the Bakerloo Line Extension (BLE) is complete, for fear that it will be compromised.

Extract from TFL’s Objection to the scheme

Extract from TFL’s Objection to the scheme

TfL make the damning accusation that Southwark has ‘no joined-up thinking’, which must sting after several years of consultation and planning for the yet-to-be adopted Old Kent Rd Area Action Plan (AAP) and Opportunity Area.

TfL examine eight aspects of the scheme for policy compliance – Strategic approach, Healthy Streets, Transport Capacity, Transport Assessment, Cycling, Car Parking, Deliveries, Funding – and gives the red light to six (meaning ‘Major changes/redesign required’), with amber for two, including ‘Funding’ (‘Further work required’)’. One of the more radical amendments TfL require for policy compliance is to move the proposed hotel, currently to face onto the Old Kent Rd, but overall TfL consider that it is ‘unlikely that the significant design changes and stringent management measures necessary to make the existing proposals workable can be made to address the issues’ raised.

The planning committee report addresses TfL’s objections at length, over 14 pages (Para 524 – 602). While it acknowledges the critical importance of the BLE to the success of the whole Opportunity Area, much of the remedy the report proposes depend on future agreements between all parties, including rival developers Tesco/Invesco, to be secured by s106 and other legal conditions after consent is granted, when the common-sense response is surely to resolve these problems before consent is given.

Conclusion

Southernwood provides the peculiar spectacle of one public authority building homes on land owned by another, but refusing to apply for public funding, because that would make an ‘unviable’ development more unviable, added to which it is promising to provide affordable housing the figures say the scheme cannot provide.

As noted above, Ruby Triangle and Cantium Retail Park were also both declared technically non-viable and depend upon the rise in land values that the Bakerloo Extension will bring, so should the problems feared by TfL occur, they may well have consequences for their promises of affordable housing too.

The TfL objections to Southernwood also adds weight to the argument that the whole Opportunity Area project is developer-driven, rather than plan-led and that the approval of major developments, such as Southernwood in advance of the adoption of the Area Action Plan is premature and rendering it redundant. Southwark should not be granting permission for a scheme in such a key location beforehand, especially when it is not due complete until 2033 and no late stage viability review is proposed.

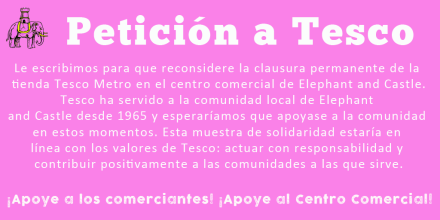

Tesco petition up and running!

Dear Friend

Our petition to get Tesco back in the shopping centre is up and running and has collected over 70 signatures – thanks to all of you who have signed already!

We need a lot more signatures though. Tesco has left traders in the lurch. They depend upon big stores attracting custom for their own business.

We want Tesco back, so please sign today

If you have already signed, please share with your friends.

Links to Twitter and Facebook here

Regards

Jerry

PS We now have a court date for our judicial review – read more here.

Keep Tesco at the Elephant!

Dear Friend

The independent traders in the shopping centre have suffered a blow with Tesco’s decision to close their Metro store permanently. Smaller traders depend on the ‘footfall’ big stores attract for much of their own business, so the closure will hit their trade too.

We have started a petition to Tesco, asking them to reverse their decision.

The store had been temporarily closed for a month to deal with a ‘pest problem’. We find it hard to believe the only solution to this is permanent closure. Tesco, Southwark Council and shopping centre owner, Delancey together can solve this problem without hurting the traders.

PLEASE SIGN AND SHARE THE TESCO PETITION TODAY!

You can read more here.

Regards

Jerry

35% Campaign update – Delancey deals double blow to shopping centre traders

Delancey deals double blow to shopping centre traders

Apr 29, 2019 12:00 am

Tesco leaves, bingo hall boarded

Traders at the Elephant and Castle shopping centre were dealt a double blow last week, by the closure of Tesco and the erection of a large unsightly hoarding, isolating shops on the second floor.

The 8-foot high boards surround the bottom of the escalator to the Palaces Bingo and Bowling Hall, which has now closed. Delancey claim it is necessary to prevent children getting onto the escalator and becoming a site for anti-social behaviour. Traders, however, have demanded its removal, saying it is blighting their trade and customers will assume that the centre is closing.

Traders were also rocked by Tesco’s announcement that it was permanently closing the Metro supermarket in the centre. This follows four weeks of closure, to deal with a mice problem.

Local news website, SE1, reported Tesco as saying “We have today announced to colleagues that we have taken the difficult decision to close our Elephant & Castle Metro store”. An earlier announcement had said that the store was only “temporarily closed” while Tesco worked with Delancey and “a specialist pest control company to take urgent steps to deal with this problem”.

Both these events will reduce the ‘footfall’ in the centre, which smaller traders rely on for their custom and the responsibility lies squarely with shopping centre owner and developer Delancey.

The hoarding on the second floor is oversized, obtrusive and unnecessary. The Palaces can be safely closed by securing the doors at the top of the escalator, and the escalator itself does not need an 8-foot high barrier to prevent children climbing on to it. The hoarding was erected without any consultation with traders and is having a detrimental impact on their businesses.

Delancey manage centre’s decline

Delancey have been the landlords of the shopping centre since 2013, when it bought the centre with the express intention of demolition and redevelopment. Tesco’s departure is clear evidence that it has failed to keep the centre as a fit place to trade. It follows traders’ long-term complaints that the centre is being deliberately run-down, complaints which were described as having ‘some validity’ by Southwark Council planning officers.

Delancey are obliged by the terms of its legal s106 agreement to give 6-month notice of both the centre’s closure and any demolition. Campaign groups and traders fear that it is evading this obligation, by closing the centre bit-by-bit. Many traders are also angry at being excluded by Delancey in its allocation of alternative premises. The latest figures from Latin Elephant show that there are still 62 shopping centre traders who haven’t been offered any relocation space.

Southwark Council have taken no action, either to deal with the rodent problem or to force Delancey to abide faithfully by its s106 agreement.

Petition – Keep Tesco at the Elephant!

We think that it cannot be beyond Tesco’s resources to solve this problem and Southwark Council should be insisting that it does so, not standing idly by. The Up the Elephant Campaign has started a petition, ‘Keep Tesco at the Elephant! – please sign it and share!

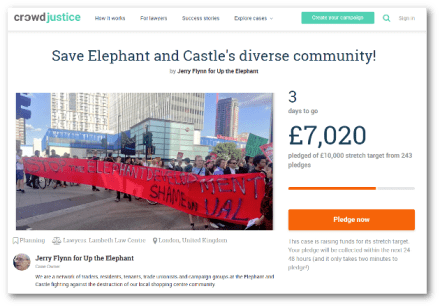

Save the Elephant’s Diverse Community!

35% Campaign is part of the Up the Elephant legal challange to the planning approval for the redevelopment of the centre, on the grounds that it fails to provide enough social rented housing. If you would like to help us in our fight, you can donate to our funding appeal here.

Love the Elephant! This Saturday!

Dear Friend

Join Southwark Notes, Latin Elephant and Up the Elephant to celebrate our precious community at Elephant and Castle and keep up the pressure for fair treatment for all our lovely traders who face displacement and eviction.

Love the Elephant street celebration!

12-3pm, Saturday 13th April

Outside Elephant and Castle shopping Centre

Timetable

12:00-1pm – Music and festivities including a short Love the Elephant procession to the shopping centre for a public display of support. Bring your DIY placards and flags please!

- Kids making sessions

- Open mic for speeches

1pm -2pm – Teach-out session: Fighting gentrification at the Elephant

2pm-3pm – Teach-out session: London traders campaigns and social cleansing

FB Event

Up the Elephant Twitter

Update from 35% Campaign on the traders’ situation

35% Campaign update – No room for traders in the new Elephant

| Mar 30, 2019 12:00 am

Shopping centre traders left out in the cold – Just thirty-six independent traders from the Elephant & Castle shopping centre have been allocated new space in which to trade, in the event of the centre’s demolition and redevelopment. Despite concerns raised by the Chair of the ‘Traders Panel’ and his fellow panel member, the figure is trumpeted in a self-congratulatory press-release from Southwark Council and belies the true situation which is that at least 40 traders have been left out in the cold, according to Latin Elephant, who champion the cause of all independant ethnic minority traders. Southwark News reported that 28 applications for space were rejected.

The new spaces are a mixture of permanent affordable units, at the base of the Elephant One Tower and on the ground floor of Perronet House (the ‘Elephant Arcade’), and temporary affordable units in Castle Square. No room on the ParkNoticeably absent from the relocation sites are the affordable retail units on Elephant Park, formerly the Heygate estate. At over 1300 sqm, with circa 800sqm available in 2019, this is by far the largest of the four sites presented to Southwark’s planning committee as alternatives for displaced traders. This 800sqm of affordable retail comprises 8 units all located on one street (Sayer St), pictured in the CGI below (extracted from Lendlease’s marketing brochure).

Unlike the other 3 sites, Elephant Park is under Lendlease control, not Delancey or Southwark, so the suspicion is that they have no desire to help Delancey, or Southwark, relocate traders, notwithstanding the ‘imagination, empathy and dedication’ it claims to be bringing to the Elephant & Castle. The CGI image above and marketing image below suggest that Lendlease’s vision doesn’t aim to include the likes of Jenny’s Burgers or the Sundial Cafe.

Lendlease’s new retail units on Sayer Street nearing completion A predictable debacleA relocation strategy that only to relocates half of those who need relocation is a failure by any measure, more so when that failure is entirely predictable. Objectors, led by Latin Elephant, have consistently pointed out that Delancey’s half-hearted and dilatory ‘strategy’ simply did not provide enough space to accommodate all the traders who wish to stay at the Elephant and this has remainded the case, even as the number of traders has inevitably changed over time. In the summer of 2017 Southwark estimated that there were about 130 independent businesses, occupying 4005sqm within the ‘red-line’ of the development (excluding the Hannibal House office space). Latin Elephant calculated that all available space, including Elephant Park (East St market spaces, nearly a mile down the road), could accommodate 84 businesses on 2,263 sqm – not much more than half the floorspace required and leaving at least 38 eligible buinesses out in the cold. In March 2018, Latin Elephant objected to Delancey’s planning application, on the grounds that the amount of affordable retail space fell far short of the 4000 sqm needed. Nonetheless, the officer’s report for the application, lumped the new shopping centre’s affordable retail with the affordable retail of Elephant One and Elephant Park. The report noted that over a third of that space would not be completed until 2024, but nonetheless reached the comforting concluson that the total of 3866 sqm was ‘only marginally short…of the 4,005sqm of space currently occupied by independent retailers on the east (shopping centre) site’ (para 221).

By January 2019, Perronet House had been approved and Castle Square itself went to planning committee, so the officer’s report for this wisely drops any reference to the shopping centre, to reach an affordable retail total of 2,859sqm. The report acknowledges that ‘whilst this would be less than the 4,005sqm currently understood to be occupied by independent businesses on the east site, some businesses may be able to operate from smaller premises’ (para 57). Southwark now identified 80 businesses in the redline and gave verbal assurances that there ‘should be sufficient’ units to accommodate everyone. In an FOI response in March 2019 Southwark gave the number of traders as 79 (an underestimate that treats the several businesses in Arch 7 as one). Wishful thinking and indifferenceWhile Southwark’s approach to relocating centre traders can be characterised as wishful thinking, Delancey’s can be characterised as indifference. It’s starting position was that providing affordable retail ‘would be unviable and inapproriate’ (para 4.63) and that a relocation strategy would only be forthcoming, once Delancey had secured planning approval (an aim it acheived). Only the concerted efforts of local campaigners and councillors has dragged concessions from Delancey, including Castle Square, a relocation fund, as well as the affordable retail units, but more is needed. Traders must be given more space for relocation and securer leases; the centre itself needs urgent maintenance and promotion, so that businesses remain viable. The relocation fund of £634,700 is not enough to for the number of traders who need its help. It’s not too lateIn the meantime, it’s not too late to put a stop to this disastrous and inequitable scheme. The application for a judicial review of the shopping centre planning permission continues its legal progress. We want the permission quashed, for a scheme with more social rented housing and a better deal for traders. You can find out more about the legal challenge here and you can help fund our fight by donating here.

|

Shopping Centre Legal Challenge, CrowdJustice launch – Tuesday March 5th 2019

Dear Friend

CrowdJustice launch – TUES MARCH 5 2019

We are now very close to launching our CrowdJustice appeal for funds to quash the Elephant shopping centre planning approval.

We have had two great fundraising events, with the Distriandina Party and the Film Night. We have now set a target of £5000 for our CrowdJusticecrowdfunding appeal.

CAN YOU MAKE A DONATION?

Can you get help us off to a flying start? Can you make a donation on the first day of our appeal on TUES 5 MARCH 2019?

We then have only 30 days to reach our target of £5000. If we can raise a good chunk of this in the first couple of days it will encourage others to donate.

The donation can be any amount – all are welcome, big or small!

Delancey want to build nearly a thousand new homes, but only 116 will be social rented – and we will have to wait nearly ten years to get them. Delancey may even get away with providing no social rented housing at all.

We think this is wrong and that is why we are going to court to try to overturn the permission. We want at least 42 more social rented homes and we know the Mayor has the money to pay for them. We want a better deal for shopping centre traders – a bigger relocation fund and lower rents.

Our community deserves a development scheme that provides homes and shops that are truly affordable for local people, not one that short-changes us.

So please help us and DONATE on TUES 5 MARCH 2019

Please share the our CrowdJustice link with your friends too!

You can find out more HERE

Developer’s estimate of profit shortfall for Verney Rd scheme.

Developer’s estimate of profit shortfall for Verney Rd scheme. Extract from

Extract from  Paragraph 256 of the

Paragraph 256 of the

Castle Square showing no sign of works commencing on the temporary boxpark

Castle Square showing no sign of works commencing on the temporary boxpark