Advice & Information

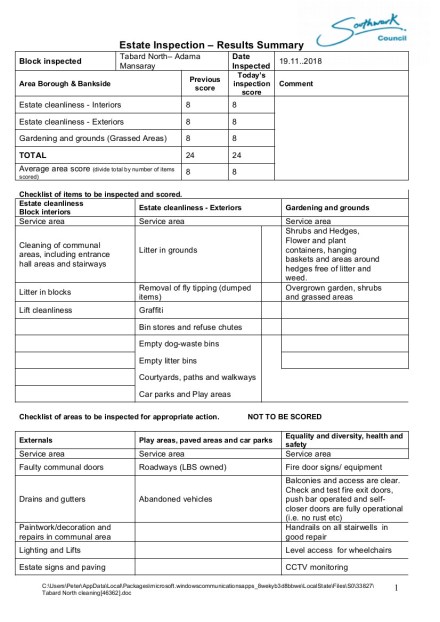

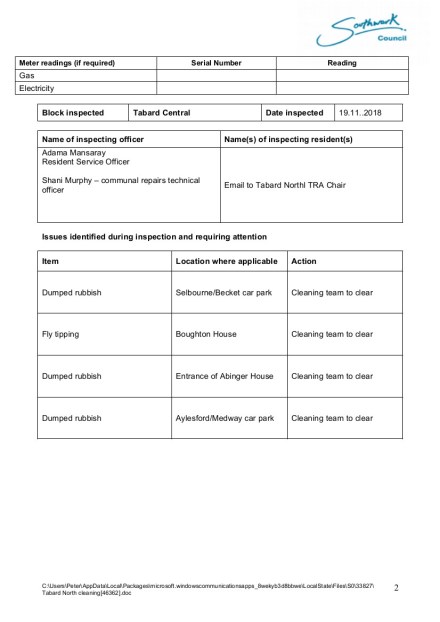

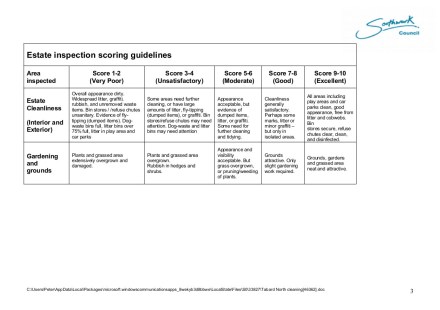

Estate Inspection October – Results Summary

35% Campaign update – 11000 new council homes: figures show loss rather than gain

Nov 12, 2018 12:00 am

Southwark demolishing and selling off council homes faster than it’s building them –

In 2014, as part of its manifesto pledge Southwark Council’s administration announced an “ambitious but realistic plan to build 11,000 new council homes” across the borough over the next 30 years. Concerns were raised by us and in the local press that this would fail to make up for the thousands of council homes currently being lost to ongoing estate regeneration, void disposal policies and Right to Buy applications over the next 30 years.

Extract from an Oct 2014 article in the local newspaper

Extract from an Oct 2014 article in the local newspaper

Council leader Peter John subsequently issued an open letter insisting that the 11,000 council homes would be over and above the existing stock count – i.e. a net increase:

Extract from Council leader Peter John’s open letter

Extract from Council leader Peter John’s open letter

Councillor John went one step further to pledge that the first 1500 net additional council homes would be finished by 2018:

Extract from 2014 Cabinet report

Extract from 2014 Cabinet report

Four years on and we have taken a look at whether Councillor John has delivered on his manifesto pledge. Official statistics from the government’s live tables on local authority dwelling stock show that since the manifesto pledge in 2014 there has been a net reduction in Southwark’s council housing stock of 476 council homes.

Extract from the government’s Live Table 116

Extract from the government’s Live Table 116

The figures aren’t saying that Southwark hasn’t built any new council homes, only that the rate at which is building has not kept up with the rate at which it is knocking them down and selling them off. The Council has or will demolish over 7,500 council homes as part of regeneration schemes, including 1200 council homes in the Heygate estate regenerationand circa 2400 on the Aylesbury estate.

In addition, it has sold 1300 council homes under the Right to Buy since 2012 and has an ongoing policy of selling every council home that becomes vacant which is valued at £300k or more.

Meanwhile, this 30th Oct 2018 Cabinet report confirms that the council has built just 262 council homes over 5 years (para 12).

The Cabinet report confirms that an additional 239 units of developer-built (S106) affordable housing have been bought by Southwark, to become council housing (para 17). One such example is Blackfriars Circus, where the Council has bought 56 homes for £10m from developer Barratt.

A problem with this method of buying council housing is that it does not actually increase the net supply of social housing – the same units would otherwise have been bought and let by a housing association anyway. Further, Southwark is denying itself the benefit of the S106 contribution, by paying for something a housing association would have paid for anyway – and, rather perversely, denying itself funds for building units that would actually increase the net supply.

It is also not clear whether all the new homes have been let at council rents. We have blogged previously about new ‘council homes’ now being let at a percentage of market rent (40%) rather than social rent (which is currently approx 20% of market rent).

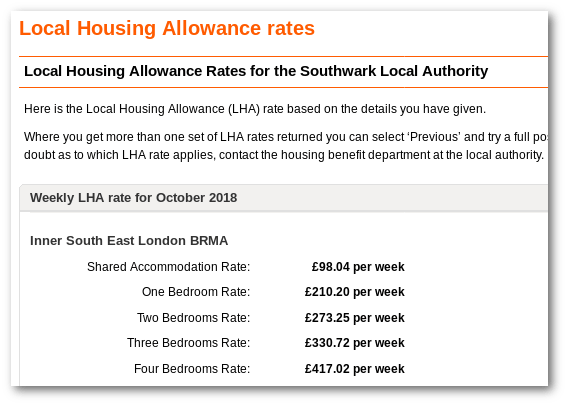

In any event, 112 of these new ‘council homes’ are temporary accommodation units in hostels (Willow Walk – 75 units, Good Neighbours House – 37 units) and are let at LHA rent levels, which are more than twice current council rent levels.

Even if we do count all these new homes as council homes at council rents, the short and long term trend is clearly one of an ongoing decline rather than net increase in the number of council homes:

General Meeting, Tuesday 20th November

St Mungo’s Putting Down Roots at Betsham and Northfleet Houses

Since 2006 Team London Bridge (the local Business Improvement District) has been managing a number of green spaces in or just on the edge of our area: Northfleet & Betsham House, The Greenwood Theatre, Melior Street Garden, Gibbon’s Rent, Whites Grounds and Snowsfields Primary School to name a few. As well as lifting the aesthetic and ecological value of public space we also see this very much as a social project.

Our involvement with residential estates is a way for our businesses to connect with the local community, and by using St Mungo’s Putting Down Roots (PDR) as our gardening contractor we are helping people out of homelessness. PDR is an initiative of St Mungo’s that provides the homeless, or those at risk of becoming so, with formal horticultural training to aid them through recovery and into eventual full-time employment.

The PDR clients are led by trainers Ian, Victoria and Jeff who will often be seen tending the Northfleet and Betsham House gardens on Tuesday and Thursday mornings. Please do say hello and they would love for residents to come out and help them if they wish (every month throughout the spring and summer they run a Saturday gardening workshop for residents as well as the usual Tuesday and Thursday mornings).

In September this year we won a Gold medal and overall winner of the Business Improvement District category at the RHS London in Bloom awards – a competition where we show off all the best green spaces (including Northfleet & Betsham House) that the area has to offer.

Thank you for the ongoing support and we’d always welcome more residential involvement and feedback. If you would to get in touch please contact Henry Johnstone at Team London Bridge henry@teamlondonbridge.co.uk

Free Gardening Workshop, 6th November

35% Campaign update – Elephant Shopping Centre – traders and campaigners step-up the fight

Oct 30, 2018 12:00 am

Campaigners mount legal challenge and object to insufficient temporary premises –

Elephant shopping Centre traders and local campaigners have taken the first step of a legal challenge to Southwark Council’s resolution to approve the shopping centre planning application, while also objecting to the small size of a proposed temporary facility for the traders’ relocation during the 5 years it would take to redevelop the centre.

The Public Interest Unit (PIU) of Lambeth Law Centre has written to Southwark, asking it to rescind the decision taken by the planning committee on 3 July 2018, or return the application to the committee. If the Council fails to do this an application will be made to the Planning Court to quash the decision.

The PIU is acting on behalf of a representative of the campaign groups Up the Elephant and Southwark Defend Council Housing. The campaign is supported by Southwark Law Centre and Latin Elephant. Barrister Sarah Sackman of Francis Taylor Building has agreed to represent the campaign.

The seven page pre-action letter gives two grounds for rescinding the permission. The first ground is that the planning committee was misled about public funding for the social housing in the scheme. The committee depended on an officer’s report in making its decision and this led it to believe that funding from the Greater London Authority (GLA), was secured for an increase of social rented housing, when this was not the case.

The second ground is that Southwark had not fulfilled its publIc sector equality duty (PSED) properly, neglecting the collective impact on the Latin American community across London, for whom the centre is a social and economic hub. Southwark had also not taken into account the impact on women business owners from black and ethnic minority backgrounds or on particular Latin American nationalities, such as Colombians, despite the detailed objections of Latin Elephant and Southwark Law Centre. The pre-action letter gives a deadline for reply of 24 Oct 2018 and this is still awaited.

The Mayor to respond

Aside from the legal challange, the Mayor Sadiq Khan will also be having his say, once the draft legal S106 agreement that would seal the planning approval is complete. Campaigners have written an open letter, asking him to reject the approval as it stands. Local ward councillors added their voice to the call, as did Assembly Member Sian Berry. Local Assembly Member Florence Eshalomi, on the question of traders, says “we cannot have these cultural communities being displaced.” Inside Housing reports that Sadiq Khan is keen to ensure that the development ‘delivers as much genuinely affordable housing as possible’.

A temporary new home for traders…

As well as contending with the consequences of any legal challenge or a call-in from the Mayor, developers Delancey must also provide a temporary facility for displaced independent traders, as a condition of planning approval for the shopping centre redevelopment.

Delancey have had to make another planning application to do this and propose a 2/3 storey building on the Castle Square market place, on their adjoining development Elephant One. Castle Square is on land owned by Southwark Council, but currently leased to Delancy on a peppercorn rent and a share of the revenue from the Square’s future street market. The shopping centre planning condition implies that Delancey will now be buying that land from Southwark.

The Castle Square facility would last for 5 years, until the Elephant & Castle Shopping Centre development has been completed. Traders would then have the first right of refusal back into the shopping centre.

..but better is needed…

The facility is a valuable gain for the traders, won by their campaign for a fair deal. Latin Elephant and the Elephant Traders welcome the concession, but have also objected that the proposed building is too small and would have trading restrictions that would make it an impractical premises for many of the displaced businesses. Delancey’s proposals mention 33 independent traders, while the trader’s own estimate is that there is a need to provide for over 100 traders. There are also many other issues, including the level of rents and service charges, the security of tenacy arrangements, selection criteria and disability access.

Delancey have agreed to the establishment of a Traders Panel and traders want these issues, and the size of the relocation fund (currently at an insufficient £634,700) to be decided by the Panel, but trader representations on the remit and format of the Panel have gone unanswered, leaving them fearful about the make-up of the Panel and how it might deal with these issues.

Delancey is not there yet

Delancey only secured a resolution to approve their shopping centre application after three planning committee meetings. It must now get a further planning permission for the trader’s temporary facility on Castle Square, before they can undertake any shopping centre redevelopment.

We must ensure that the traders get the best possible deal, whatever happens; they need the temporary facility, but it must be better; if you would like to help achieve this, please submit an objection using our online web form.

Recent Articles:Ruby Triangle |

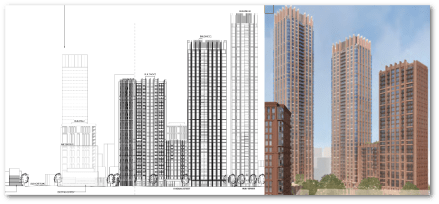

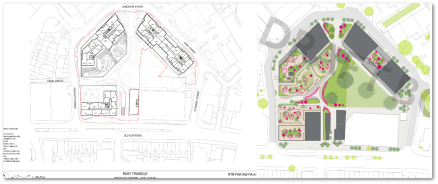

35% Campaign update – Ruby Tuesday

|

35% Campaign update – Grosvenor takes the biscuit factory

Grosvenor takes the biscuit factorySep 25, 2018 01:00 am Bermondsey’s Biscuit Factory redevelopment falls well short of policy requirements – 1300 new homes, no social rentedWhile most eyes have been on developer Delancey’s plans for the redevelopment of the Elephant and Castle shopping centre, on the other side of Southwark an equally large proposal to build over a thousand homes without any social rented housing has been stealthily making its way towards planning permission. Grosvesnor Estates bought the Biscuit Factory site in Bermondsey in 2013. The total site combines the former homes of biscuit manufacturer Peek Freans and the former Bermondsey campus of Lewisham and Southwark FE College. Peek Freans closed in 1989, the college left in 2013 and the site is currently occupied by a variety of businesses and offices. Grosvenor proposes a £500m mixed-use development of 1343 new homes with 21000 sqm of other uses, and a new school. The homes will all be Build to Rent (BtR), owned and managed by Grosvenor; none of the homes will be for sale. Grosvesnor are offering 27.5% ‘affordable’ housing at an average of 75% market rents, near the allowed maximum of 80%. No social rented housing or ‘social rent equivalent’ affordable housing is proposed. Grosvenor offer to be ‘flexible’ about the range of affordable rents, but insist that the average of 75% must be maintained, so any gains at the bottom end would force rents at top end, beyond even 75%, or further reduce the overall quantum of affordable housing. Southwark Council’s adopted housing policy does not support BtR. The housing policy for this part of Bermondsey requires 35% affordable housing, 70% of which should be social rent. This would amount to around 470 affordable units in total, 330 of which should be social rent. Policy also requires that the remainder of the affordable housing be shared ownership. By contrast, the affordable housing in Build to Rent is a form of affordable rent, at up to 80% market rent. Since 2011 Southwark have maintained that affordable rent does not meet the borough’s housing needs, but it is now in the middle of a sharp policy u-turn, which proposes allowing affordable rent (called Discounted Market Rent) in the latest version of the local plan, the New Southwark Plan (NSP) (see policy P4). Grosvenor are taking advantage of the situation (and employing the same tactic as Delancey) by relying on this so-called ‘emerging’ policy, rather than the policy as it stands, to get their BtR application through planning committee. The London Plan, Sadiq Kahn’s draft housing strategy 2016 and the government’s White Paper also provide encouragement to impatient BtR developers. Even if ‘emerging’ policy were applied to allow a BtR development, Grosvenor’s affordable housing offer still comprehensively fails to fulfill its demands. The NSP Policy P4 for BtR requires 35% total affordable housing, made up of 12% ‘social rent equivalent’, 18% London Living Rent, and 5% for £60k-£90k incomes. Grosvenor falls short on every measure – 0% social rent equivalent, 0% London Living Rent, 100% at £60k-£90k market rent, and only 27.5% affordable housing in total. Other areas where Grosvenor’s scheme fails policy tests are the number of studio flats – (146; there should be no more than about 70 (5%), according to Southwark’s Core Strategy) and the length of covenant keeping the BtR units as rented tenure (a 15 year covenant is offered, emerging policy requires thirty years). Management and lettings of affordable housing also appears to be a problem. Grosvenor makes no mention of using a registered provider and is evidently reluctant to extend tenant nominations to Southwark. Grosvenor stresses that while ‘it will work with LBS to enable prospective tenants to be sourced from any such list’ (ie Southwark’s proposed intermediate housing list)…The lettings and nominations arrangements will need to recognise that Grosvenor will need ultimate control over the occupation and management of the Proposed Development’. Estimated profit of £99m not enoughAs always the lack of affordable housing is justified by viability and it is no surprise to see that the viability assessment has been drafted by DS2, who did the same job for Delancey’s shopping centre development. In keeping with Southwark’s development viability policy we won’t get to see the full assessment until a week before it goes to planning committee, and have to rely on an executive summary for any idea of the scheme’s finances. The executive summary is deficient, policy-wise, in several respects; the construction, acquisition and other development costs and professional fees are lumped into one figure, instead of given seperately. Instead of developer profit (on cost) Grosvenor has submitted an ‘Internal Rate of Return’, which is given as an obscure percentage (7%), not as a readlily understandable cash figure. Despite the obscurity, we have run our own calculation of profit (on cost), by subtracting the total costs listed from the gross development value, which gives a figure of £99m. This is not enough for Grosvenor, who reckon a ‘reasonable return’ is 12% IRR and they‘therefore cannot afford to deliver any affordable housing’. Southwark’s required format vs Grosvenor’s submitted FVA summary In the viability assessment summary Grosvenor’s total scheme costs are combined together as a lump sum of £755m. This is significantly higher than the £500m estimate stated in its marketing material, press release and media reports. Given that we are not privy to the full viability assessment or its appraisal by the Council’s appointed experts GVA, we can only hope that Grosvenor are asked to explain this £250m discrepancy… Extract from Grosvenor’s marketing material School’s outGrosvenor also claim that there can be no affordable housing because of a list of other benefits the scheme provides, including ‘the delivery of a new school’, despite Section 13 of its Planning Statement acknowledging that ‘the construction of the new school is anticipated to be funded by the ESFA (Education and Skills Funding Agency)’. All is not lost though, because Grosvenor generously propose that ‘notwithstanding the overall scheme viability, it would be willing to offer 27.5% affordable housing, delivered as discount market rented (“DMR”) homes (“Grosvenor’s Offer”).’ The average discount would be 25% ie 75% market rents, close to the maximum of 80% allowed for ‘affordable rent’. Exactly how much this will be we are left to guess – unlike Delancey’s proposals for the shopping centre Grosvenor does not provide any rent tables for either the market or affordable housing. Current new-build market rents in the SE16 postcode are upwards of £1500pcm. The House of WestminsterThe Grosvenor Estate ‘represents all the business activities of the Grosvenor Family, headed by the Duke of Westminster’. One of its three arms is Grosvenor Group which ‘represents the majority of the Grosvenor Estate’s urban property activities and is its largest business’. This in turn includes Grosvenor Americas, Grosvenor Asia Pacific and Grosvenor Britain & Ireland, which has £5.1bn of assets and is the applicant for the Biscuit Factory. The Biscuit Factory is also the number one development listed in the Grosvenor Britain & Ireland’s summary of developments. Thanks to a secretive network of offshore firms, the Duke of Westminster is reputed to be worth £9bn and is the world’s richest man under 30. The Biscuit Factory on the other hand, is on the doorstep of South Bermondsey and Rotherhithe, two of six Southwark wards with neighbourhoods classified as being in the bottom 10% most deprived in the country, so the need for social rented housing hardly needs demonstrating. Grosvenor’s spin on the Biscuit Factory that it will bring life to a ‘burgeoning new neighbourhood in London’, artfully propogated by the usual community engagement soft-soap, but if Grosvenor had any genuine interest in the community it would simply build the affordable housing that local planning policy requires and build social rented housing; the demands are not onerous. As it is, one of the very richest families in the country will be getting richer at the expense of people in one of its poorest areas, by depriving them of the homes they need. This is not a planning application that deserves approval, by any measure. Southwark’s planning committee came close to throwing out Delancey’s shopping centre application; it should make no mistake this time and send Grosvenor and its dreadful planning application packing. You can help by objecting to the application, either by following this link or by using the automated objection form below with our suggested wording. Object Now!Fill in the details below to object to Delancey’s revised planning application. * indicates required Title: * First Name: * Surname: * Email: * Address: * Town/City: * Postcode: * Comment: Dear Southwark Planning, I am writing to object to the planning application for the redevelopment of the TOWER BRIDGE BUSINESS COMPLEX, 100 CLEMENTS ROAD AKA THE BISCUIT FACTORY & BERMONDSEY CAMPUS SITE, KEETONS ROAD LONDON, SE16 4DG (ref:17/AP/4088). Affordable Housing: This application does not propose a policy compliant affordable housing mix. Southwark’s policy for this site requires a minimum of 35% affordable housing, of which 70% must be social rented. This should provide around 470 affordable units in total, about 330 of which should be social rent. Grosvenor is proposing 27.5% affordable housing, but not social rented housing. The affordable housing will also be affordable rent at an average 75% market rent, near the maximum 80% market rent allowed. Since 2011 Southwark Council has maintained that affordable rent does not meet the borough’s housing needs. The development will be on the doorstep of neighbourhoods that are amongst the most deprived in the country and the borough has a desperate need for social housing. There can be no justification for approving this application and it should not be considered until there is a policy compliant mix of affordable housing. Yours sincerely, Send Objection |

Extract from the GLA’s

Extract from the GLA’s