|

Neighbourhood Development

35% Campaign update – Grosvenor takes the biscuit factory

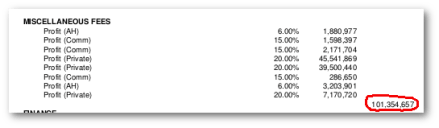

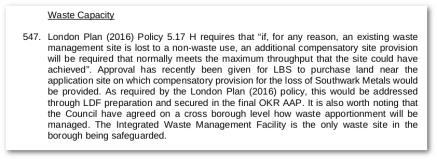

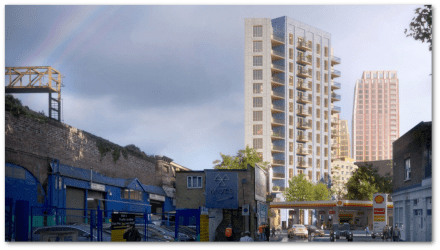

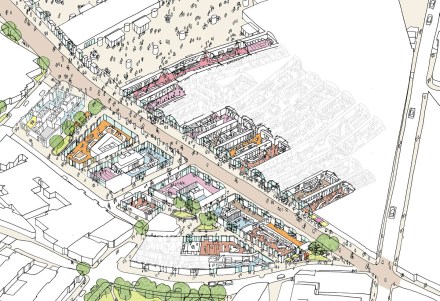

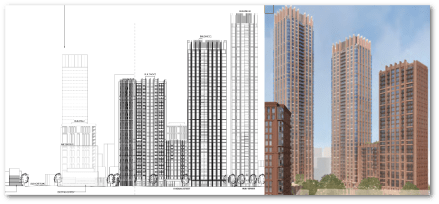

Grosvenor takes the biscuit factorySep 25, 2018 01:00 am Bermondsey’s Biscuit Factory redevelopment falls well short of policy requirements – 1300 new homes, no social rentedWhile most eyes have been on developer Delancey’s plans for the redevelopment of the Elephant and Castle shopping centre, on the other side of Southwark an equally large proposal to build over a thousand homes without any social rented housing has been stealthily making its way towards planning permission. Grosvesnor Estates bought the Biscuit Factory site in Bermondsey in 2013. The total site combines the former homes of biscuit manufacturer Peek Freans and the former Bermondsey campus of Lewisham and Southwark FE College. Peek Freans closed in 1989, the college left in 2013 and the site is currently occupied by a variety of businesses and offices. Grosvenor proposes a £500m mixed-use development of 1343 new homes with 21000 sqm of other uses, and a new school. The homes will all be Build to Rent (BtR), owned and managed by Grosvenor; none of the homes will be for sale. Grosvesnor are offering 27.5% ‘affordable’ housing at an average of 75% market rents, near the allowed maximum of 80%. No social rented housing or ‘social rent equivalent’ affordable housing is proposed. Grosvenor offer to be ‘flexible’ about the range of affordable rents, but insist that the average of 75% must be maintained, so any gains at the bottom end would force rents at top end, beyond even 75%, or further reduce the overall quantum of affordable housing. Southwark Council’s adopted housing policy does not support BtR. The housing policy for this part of Bermondsey requires 35% affordable housing, 70% of which should be social rent. This would amount to around 470 affordable units in total, 330 of which should be social rent. Policy also requires that the remainder of the affordable housing be shared ownership. By contrast, the affordable housing in Build to Rent is a form of affordable rent, at up to 80% market rent. Since 2011 Southwark have maintained that affordable rent does not meet the borough’s housing needs, but it is now in the middle of a sharp policy u-turn, which proposes allowing affordable rent (called Discounted Market Rent) in the latest version of the local plan, the New Southwark Plan (NSP) (see policy P4). Grosvenor are taking advantage of the situation (and employing the same tactic as Delancey) by relying on this so-called ‘emerging’ policy, rather than the policy as it stands, to get their BtR application through planning committee. The London Plan, Sadiq Kahn’s draft housing strategy 2016 and the government’s White Paper also provide encouragement to impatient BtR developers. Even if ‘emerging’ policy were applied to allow a BtR development, Grosvenor’s affordable housing offer still comprehensively fails to fulfill its demands. The NSP Policy P4 for BtR requires 35% total affordable housing, made up of 12% ‘social rent equivalent’, 18% London Living Rent, and 5% for £60k-£90k incomes. Grosvenor falls short on every measure – 0% social rent equivalent, 0% London Living Rent, 100% at £60k-£90k market rent, and only 27.5% affordable housing in total. Other areas where Grosvenor’s scheme fails policy tests are the number of studio flats – (146; there should be no more than about 70 (5%), according to Southwark’s Core Strategy) and the length of covenant keeping the BtR units as rented tenure (a 15 year covenant is offered, emerging policy requires thirty years). Management and lettings of affordable housing also appears to be a problem. Grosvenor makes no mention of using a registered provider and is evidently reluctant to extend tenant nominations to Southwark. Grosvenor stresses that while ‘it will work with LBS to enable prospective tenants to be sourced from any such list’ (ie Southwark’s proposed intermediate housing list)…The lettings and nominations arrangements will need to recognise that Grosvenor will need ultimate control over the occupation and management of the Proposed Development’. Estimated profit of £99m not enoughAs always the lack of affordable housing is justified by viability and it is no surprise to see that the viability assessment has been drafted by DS2, who did the same job for Delancey’s shopping centre development. In keeping with Southwark’s development viability policy we won’t get to see the full assessment until a week before it goes to planning committee, and have to rely on an executive summary for any idea of the scheme’s finances. The executive summary is deficient, policy-wise, in several respects; the construction, acquisition and other development costs and professional fees are lumped into one figure, instead of given seperately. Instead of developer profit (on cost) Grosvenor has submitted an ‘Internal Rate of Return’, which is given as an obscure percentage (7%), not as a readlily understandable cash figure. Despite the obscurity, we have run our own calculation of profit (on cost), by subtracting the total costs listed from the gross development value, which gives a figure of £99m. This is not enough for Grosvenor, who reckon a ‘reasonable return’ is 12% IRR and they‘therefore cannot afford to deliver any affordable housing’. Southwark’s required format vs Grosvenor’s submitted FVA summary In the viability assessment summary Grosvenor’s total scheme costs are combined together as a lump sum of £755m. This is significantly higher than the £500m estimate stated in its marketing material, press release and media reports. Given that we are not privy to the full viability assessment or its appraisal by the Council’s appointed experts GVA, we can only hope that Grosvenor are asked to explain this £250m discrepancy… Extract from Grosvenor’s marketing material School’s outGrosvenor also claim that there can be no affordable housing because of a list of other benefits the scheme provides, including ‘the delivery of a new school’, despite Section 13 of its Planning Statement acknowledging that ‘the construction of the new school is anticipated to be funded by the ESFA (Education and Skills Funding Agency)’. All is not lost though, because Grosvenor generously propose that ‘notwithstanding the overall scheme viability, it would be willing to offer 27.5% affordable housing, delivered as discount market rented (“DMR”) homes (“Grosvenor’s Offer”).’ The average discount would be 25% ie 75% market rents, close to the maximum of 80% allowed for ‘affordable rent’. Exactly how much this will be we are left to guess – unlike Delancey’s proposals for the shopping centre Grosvenor does not provide any rent tables for either the market or affordable housing. Current new-build market rents in the SE16 postcode are upwards of £1500pcm. The House of WestminsterThe Grosvenor Estate ‘represents all the business activities of the Grosvenor Family, headed by the Duke of Westminster’. One of its three arms is Grosvenor Group which ‘represents the majority of the Grosvenor Estate’s urban property activities and is its largest business’. This in turn includes Grosvenor Americas, Grosvenor Asia Pacific and Grosvenor Britain & Ireland, which has £5.1bn of assets and is the applicant for the Biscuit Factory. The Biscuit Factory is also the number one development listed in the Grosvenor Britain & Ireland’s summary of developments. Thanks to a secretive network of offshore firms, the Duke of Westminster is reputed to be worth £9bn and is the world’s richest man under 30. The Biscuit Factory on the other hand, is on the doorstep of South Bermondsey and Rotherhithe, two of six Southwark wards with neighbourhoods classified as being in the bottom 10% most deprived in the country, so the need for social rented housing hardly needs demonstrating. Grosvenor’s spin on the Biscuit Factory that it will bring life to a ‘burgeoning new neighbourhood in London’, artfully propogated by the usual community engagement soft-soap, but if Grosvenor had any genuine interest in the community it would simply build the affordable housing that local planning policy requires and build social rented housing; the demands are not onerous. As it is, one of the very richest families in the country will be getting richer at the expense of people in one of its poorest areas, by depriving them of the homes they need. This is not a planning application that deserves approval, by any measure. Southwark’s planning committee came close to throwing out Delancey’s shopping centre application; it should make no mistake this time and send Grosvenor and its dreadful planning application packing. You can help by objecting to the application, either by following this link or by using the automated objection form below with our suggested wording. Object Now!Fill in the details below to object to Delancey’s revised planning application. * indicates required Title: * First Name: * Surname: * Email: * Address: * Town/City: * Postcode: * Comment: Dear Southwark Planning, I am writing to object to the planning application for the redevelopment of the TOWER BRIDGE BUSINESS COMPLEX, 100 CLEMENTS ROAD AKA THE BISCUIT FACTORY & BERMONDSEY CAMPUS SITE, KEETONS ROAD LONDON, SE16 4DG (ref:17/AP/4088). Affordable Housing: This application does not propose a policy compliant affordable housing mix. Southwark’s policy for this site requires a minimum of 35% affordable housing, of which 70% must be social rented. This should provide around 470 affordable units in total, about 330 of which should be social rent. Grosvenor is proposing 27.5% affordable housing, but not social rented housing. The affordable housing will also be affordable rent at an average 75% market rent, near the maximum 80% market rent allowed. Since 2011 Southwark Council has maintained that affordable rent does not meet the borough’s housing needs. The development will be on the doorstep of neighbourhoods that are amongst the most deprived in the country and the borough has a desperate need for social housing. There can be no justification for approving this application and it should not be considered until there is a policy compliant mix of affordable housing. Yours sincerely, Send Objection |

EAN meeting – Tuesday 18th September 7pm

Dear Friend

The next meeting of the Elephant Amenity Network will be on 7pm Tues 18 Sept 2018 Bingo Room, 3rd Floor, Elephant and Castle Shopping Centre.

The agenda will include;

- report back on meeting of shopping centre traders and GLA

- Castle Square planning application for temporary facility for traders

- Crowdfunding and campaign activity

- The London Plan – Examination in Public

- Latest on the Old Kent Rd Opportunity Area planning applications

Joint campaign asks mayor of London to bin the Elephant scheme

From Elephant Amenity Network

Dear friend,

You will know by now that the shopping centre planning application has been approved, by a very narrow margin. However there is still some distance to go before the development goes forward and the Mayor of London still has to give his endorsement to Southwark’s decision.

We are campaigning now to get the Mayor to refuse to do this, as he has the power to do. We have now sent a joint open letter to the Mayor asking him to call the application in and improve the offer or direct a refusal.

Our letter to Mayor Sadiq Khan is here (pdf)

Green Party AM Sian Berry has also written to the Mayor:

https://www.southwarkgreenparty.org.uk/call_in_the_elephant_decision_says_sian

Please SIGN THE PETITION

Sadiq: Say NO to the displacement of BAME communities from Elephant & Castle

Eight Labour Councillors, including the local ward councillors and the deputy leader, have made their dissatisfaction with the decision clear and have also asked London mayor Sadiq Khan to make improvements. London Assembly member Florence Eshalomi and a local Labour ward has added their voices to the call.

Many local Labour branches have passed a motion opposing the decision to approve the application and asking Sadiq to intervene. This has caused a spat inside Labour, with the local MP Neil Coyle bizarrely accusing one of these branches of “bullying”. This article in Southwark News has more details:

https://www.southwarknews.co.uk/news/neil-coyle-goes-to-war-with-his-own-party-after-blasting-labour-bullies-and-trolls/

Campaign groups, including the 35% Campaign, Latin Elephant and Up the Elephant have also vowed to continue the fight.

Shopping centre redevelopment – opposition grows

From Elephant Amenity Network

Dear Friend

Despite being approved by the planning committee there is growing opposition to the Elephant and Castle shopping centre scheme.

The scheme must be approved by Mayor Sadiq Khan and a NEW petition organised by Latin Elephant is calling on him to either direct refusal of the application or take it over himself.

Southwark Defend Council Housing had a stall at the SGTO summer fest in Camberwell yesterday and got a good response to the campaign to stop the scheme. Labour Party branches and Camberwell and Peckham Constituency Labour Party have also demanded that Mayor Sadiq Khan calls this application in. You can see the motion they passed here. Green AM Sian Berry has also written to the Mayor, as have ward Councillors.

PLEASE sign the online petition here.

You can also send objections and comments to here – mayor@london.gov.uk – quoting Southwark Council planning ref 16/AP/4458

Regards

Jerry

EAN Shopping centre meeting 17 July

From the Elephant Amenity Network

Dear Friend

You will know by now that the shopping centre planning application has been approved, by a very narrow margin. However there is still some distance to go before the development goes forward and the Mayor of London had to give his endorsement to Southwark’s decision.

We are campaigning now to get the Mayor to refuse to do this, as he has the power to do, and this will be the main item on the agenda of our next meeting, which will be will be next Tues 17 July 2018, 7pm, Bingo room, Palaces Bingo, 3rd Floor shopping centre.

Please bring the attached invite.

Meantime – Please SIGN THE PETITION

Sadiq: Say NO to the displacement of BAME communities from Elephant & Castle

Eight Labour councillors, including the local ward councillors and the deputy leader, have made their dissatisfaction with the decision clear and have also asked London mayor Sadiq Khan to make improvements. London Assembly member Florence Eshalomi and a local Labour ward has added their voices to the call.

Campaign groups, including the 35% Campaign, Latin Elephant and Up the Elephant have also vowed to continue the fight.

See http://35percent.org/2018-07-09-delancey/

Hope to see you on Tuesday

Regards

Jerry

Delancey get what they want

E&C shopping centre application narrowly approved

lancey for the delivery of the development. A late application to Historic England for listing the shopping centre has also to be resolved.

Winners and losers

Southwark’s planning officers were frank when presenting the merits of the proposed development – there were going to be positives and negatives (the negatives known as ‘disbenefits’). In the positive column was a contribution towards a new Northern Line tube entrance, a new London College of Communication campus for University of the Arts London, new homes and new shops. In the negative column was the displacement of the current traders and the unaffordability of the new homes and new shops for local people (or indeed for most people in Southwark). It was for the committee to decide whether the balance lay and in the event it decided by a 4 to 3 vote, with one abstention, to approve the application.

In reaching this decision the committee accepted that the so-called mitigation measures, designed to minimise the harm to traders and other users, were sufficient to allow a vote in favour of the development. The committee also set aside its own adopted housing policy which lays out clearly how much affordable housing is required, what type it should be and how much should be social rented. Instead it chose to measure the affordable housing offer against a so-called ‘emerging’ policy, championed by Delancey and other developers, and which entails building less social rented housing (12% of total housing against 17.5%, for the Elephant area). The affordable housing offer even fails by this measure, because it has too little London Living Rent (LLR) and, at nearly half the total units, too much affordable housing at 80% market rent, but the application was approved despite all this.

Housing policy Pick n’ Mix

As a bonus Delancey also obtained the option of a Build to Sell (BtS) scheme on the West site, while still retaining a Build to Rent (BtR) scheme as its main proposal. This means the committee has approved a major application without knowing the exact tenure of half the housing. Other complications arise because different housing policies apply, depending on whether a scheme is BtS or BtR, and each has different affordable housing requirements. If the BtS scheme is chosen, then more social rented housing would be required (subject to viability). Council officers insisted that they were ‘confident’ that this additional social housing would be secured, because of their expertise in monitoring S106 agreements (not a confidence the Local Government Ombudsman shares).

The BtR scheme has its own complications, one of which is ensuring that the proportion of LLR units are maintained at the consented level. This is a problem, because Delancey wants to reassess eligibility for what it likes to call ‘subsidised housing’ at the end of every 3-year tenancy. If a LLR household has enjoyed a salary increase over this time, it may jump up a rent band and cease to be eligible to remain in a LLR home. The number of LLR units is already too low, (53 against about 150 units) and Southwark have proposed two equally impractical and almost incomprehensible ways of making sure they do not drop further. The officers were not asked to explain why Southwark feels the need to contort itself this way and not simply tell Delancey to comply with adopted policy and thus avoid these complications. The committee did ask some questions on the practical effect on tenants of this recurrent means-testing, such as what happens if a tenant household income goes above £80,000 pa (answer: the rent doubles) and would you have to leave (yes, could happen). The planning officers again reassured the committee that they can resolve this affordable housing dog’s dinner in a consistent and flexible way, in S106 negotiations.

Traders’ suffering squared away

The committee decision to approve the application also tacitly accepts officers’ assurances that all that could be done to mitigate harm to the traders was being done. This was despite the traders’ objections that there was no relocation strategy in place, that the relocation fund was inadequate (£634,700 – an average of about £6,000 per trader, according to one committee member) and that their businesses were being ruined by Delancey’s poor upkeep of the centre, as well as future uncertainty; traders have been told by Delancey they would have to leave the centre by March 2019, regardless of the outcome of the planning application. A trader’s panel is now to be put in place to solve all these problems.

Southwark is also content that it is fulfilling its public sector equality duty (ie that it has paid due regard to the harm the development will cause to ethnic minority and other groups), despite being warned by Southwark Law Centre and Latin Elephant that it has ignored other protected groups, such as women and the young. Palaces’ bingo and bowling has withdrawn its objection to the application, but council officers acknowledged that allowing a bingo operator first right of refusal for the use of some leisure space does not guarantee the bingo will return in the new development. Nor does this right of refusal solve the problem of what bingo users do between the centre’s demolition and completion of the new development. Most of the bingo users are from black and ethnic minority backgrounds. The bowling alley, much used by young people, does not benefit from even the small protection given to the bingo.

Profit vs cost

The justification for accepting a proposal that drove a coach and horses through its housing policy and displaces the Latin American and ethnic community who have made the Elephant their social home was ‘viability’. Delancey told the committee that their estimated level of profit was at ‘breaking point’ and nothing more could be offered in the way of affordable housing, but then stunned everyone but themselves with the admission that it was only paying £260,000 towards the extra 42 social rented units (lifting the number from 74 to 116 units), the rest of the cost being met by a GLA affordable housing grant of £11.25m, thus maintaining Delancey’s estimated profit at £148.4m. This equates to about 15% GDV (gross development value) or 1.5% pa, according to Delancey.

The committee rests its hopes of improving the affordable housing through a so-called viability review mechanism, which at some later date will supposedly establish the achieved level of profit. Southwark’s viability advisor’s, GVA endorsed this approach, saying that it would be an open-book appraisal, with all the figures being made available, but given that Delancey are even now keeping critical information confidential and Delancey’s off-shore company structure one can be forgiven for doubting this.

GVA’s written advice cautions ‘It should also be noted that there is no certainty that the Social rent on the West Site will be delivered as this is some way in the future’. All the 116 social rented units will be on the West Site and although this was said before Delancey secured the promise of GLA funding, it is still a pertinent warning.

Fortune favours UAL

Staunch support from the University of the Arts London (UAL) undoubtedly helped turn at least one committee member’s vote Delancey’s way, through fear of the LCC upping sticks were the application rejected and UAL will be rewarded with a new London College of Communication campus. We know from staff and students that new facilities are much-needed and no-one wishes to see the LCC lost to the Elephant or Southwark, where they do much worthy educational work, but the fact remains that UAL, along with TfL, are the only current occupants of the Elephant who will unequivocally benefit from this new development. Much will depend on the final terms of the S106 agreement, which will include the conditions on the traders’ relocation and the traders’ fund, amongst other things; UAL should use all its influence with Delancey, on behalf of the traders, to get the best deal possible.

It will not be plain sailing for Delancey

The council officers’ repeated response when the committee voiced reservations about the application was that the approval would not be sealed until the S106 agreement was concluded, where their concerns would be addressed. A proposal from the local councillors that the S106 agreement return to the planning committee to ensure this was not accepted.

Eight Labour councillors, including the local ward councillors and the deputy leader, have made their dissatisfaction with the decision clear and asked London mayor Sadiq Khan to make improvements. London Assembly member Florence Eshalomi and a local Labour ward has added their voices to the call.

Sadiq Khan has wide planning powers and can direct refusal of a strategic planning application, or take over the decision-making himself and given the small amount of one of his favoured housing tenures, London Living Rent homes, he might be inclined to do so, although his GLA officers have been largely supportive, of the application, with reservations about treatment of the traders. He has 14 days to make a decision from the date of the committee meeting.

Campaign groups, including the 35% Campaign, Latin Elephant and Up the Elephant have also vowed to continue the fight.

The exemplary SE1 twitter feed gives a blow-by-blow account of the meeting, which can also be viewed on You Tube.

35% Campaign update – Delancey’s subsidised profit

Delancey’s subsidised profit

Jul 02, 2018 12:00 am

Courtesy of GLA

Just over a week before the shopping centre planning application goes before Southwark’s planning committee for the third time a slew of viability documents have been released. Given the size of the main document, the full financial viability assessment (FVA) it has not been possible for campaigners to present a complete response, but some interesting facts have come to light nonetheless.

As is usual developer Delancey claims its affordable housing offer is the most it can viably provide, but it falls some way short of what Southwark’s planning policy requires, as is also usual. Delancey has upped the number of social rented units from 33, first to 74 and then to 116, but this is still some way short of the circa 165 units needed for policy compliance. Delancey were helped along by a £11.25m grant from the Greater London Authority (GLA), which promptly found its way straight to Delancey’s bottom line, increasing its profit by exactly the same amount. We can see this be comparing two development appraisals of the scheme. The first, dated 13 June 2018, is for a scheme with 116 social rented units, but without grant funding, and has a profit of £137.1m. The second, dated 22 June 2018, is also for a scheme with 116 social rented units, but includes a £11.25m GLA grant, and, by a miracle of development finance, a profit of £148.4m. Delancey have responded to justified cries of ‘subsidise homes, not profit’ pretty much confirming that this is what has happened, but referring to the difference in the profit levels as a ‘viability gap’ and pleading that it ‘maintains’ the profit, not ‘enhances’ it. Most people will struggle to see the difference and would think the money better spent on the social housing Delancey claims it cannot afford to build.

The price of a unit

Another curiosity is the price of the social rented units. Delancey will not be building them for nothing and they will be sold to a registered provider of affordable housing or Southwark Council. The unit price given in both the June development appraisals is £229,864 (total £26.66m for 116 units). However an earlier development appraisal, dated 20 Feb 2018, for the first revised offer of 74 social rented units gives the unit price as £78,674, (total £5.82m). Clearly Delancey have more than one way of ‘maintaining’ profits; together with the GLA grant profit will have been ‘maintained’ by public money to the tune of £32m, all as a result of Delancey revising upwards its original affordable housing offer.

Delancey also cocks a snook at Southwark’s much trumpeted viability transparency policy, by keeping important information confidential. The Existing Use Value (EUV) of a development site is a critical figure in determining how viable a site is and, simply put, the higher the EUV is the less there will be for affordable housing. Delancey is claiming an EUV of £175,000,000 (Southwark’s independent advisor, GVA assumes a lower figure of £138,000,000). Delancey says there is supporting information to underpin its higher figure, but adds loftily ‘However, the reports contain information to the existing landowner and cannot be divulged’.

All this aside it is quite clear from the viability section in the officer’s report on the planning application that Delancey’s scheme can fund a fully compliant amount of affordable housing. However, Southwark are choosing to appease Delancey by accepting the lower amount on offer and proposing a viability review at a later date, and waiting to see if there can be any ‘uplift’. This is a mistake, because it shifts risk from Delancey to Southwark – if Delancey should make less money than estimated, it will mean less affordable housing, not less profit. The viability review would also be one of the legal s106 conditions on any planning approval, which Delancey has previously succeeded in changing to its own advantage at its ‘ELEPHANT ONE’ development, right next door to the shopping centre.

The decision on this application is in the balance. There will be a demonstration before the planning committee meeting Up the Elephant Tuesday 3rd July @ 5:30pm; Southwark Council Offices, 160 Tooley Street, London SE1 2QH (Planning Committee starts at 6:30pm)

More info can be found here

35% Campaign update – Shopping Centre redevelopment – Delancey tries again

Shopping Centre redevelopment – Delancey tries againJun 26, 2018 12:00 am Application returns to the planning committee Elephant shopping centre owner and developer Delancey will be hoping it is third time lucky when Southwark’s planning committee considers their application for redeveloping the centre on 3 July. The committee chose not approve the application at two meetings in January and the decision was further deferred because of local elections in May. Delancey’s initial failure, though, was the result of a concerted campaign which united shopping centre traders, the local Latin American community, staff and students from the London College of Communication, local housing campaigners and local councillors. There were over 900 objections. Delancey has used the time since to make some modest improvements to the application. The number of social rented homes was first increased from 33 to 74 units and then, within the last week, up to 116 units. The units will be purchased and managed by Southwark Council, not a private sector registered provider as previously proposed. Interim retail units are also being built, to accommodate at least some of the displaced traders, on Castle Sq, just over the railway from the centre. Any trader within the ‘red-line’ of the development will be eligible for support from the relocation strategy. A ‘cluster’ of affordable retail and affordable space is proposed for Pastor St, behind the London College of Communication. There is also a qualified commitment to lease a proportion of the proposed leisure floorspace to a bingo operator. Delancey says it “will give first refusal (on commercial terms) to a bingo operator to lease a proportion of the proposed leisure floorspace within the development.” The Palaces bingo hall and bowling alley in the shopping centre are major attractions in the area. These improvements are valuable for some, but for most traders it is all too little, too late. Local charity Latin Elephant reckons there are 150 migrant and ethnic businesses at the Elephant. The Elephant and Castle Traders Asssociation counts traders from 16 different countries, stretching from Bolivia to Turkey to Bangladesh and Ghana. They have been informed that they will have to leave the centre by March 2019 (regardless of the outcome of the planning application) and there is little doubt that Delancey’s proposals will not accommodate them all. Moving the chairs aroundThe improved housing offer comes at a cost too, but not for Delancey. While there will be more social rented homes, it is at the expense of London Living Rent units, much favoured by Mayor Sadiq Khan as the best tenure for households with middle incomes up to £60k per annum; these have been reduced from 158 in the original proposal to 53 units in the latest offer. At the same time the affordable rent units at 80% market rent have increased in number from 59 to 161. Delancey have reconfigured the offer (as noted by Southwark’s viability advisors GVA) and still stand to make £137m profit, according to their latest Development Appraisal. Delancey is also seeking funding from the GLA to build its affordable housing (£60k per social rented unit) which it will then sell to Southwark Council for an estimated £26.7m (£230k per unit). Despite all this the affordable housing offer is still does not meet the requirements of the adopted local plan; there would have to be at least 170 social rented units, amongst other things, for this to happen. Delancey instead hopes to get the advantage of new policy that is in pipeline, so called emerging policy, which requires less social rented housing and favours the Build for Rent type scheme Delancey is proposing, rather than the traditional Build for Sale scheme. Poor designNone of Delancey’s amendments involve changes to the design of the scheme, which Southwark’s Design Review Panel have criticised heavily, in particular in relation to the transport interchange. In their report to the Council’s planning committee they said that the “significant size and scale of the proposed UAL and the shopping centre buildings adjacent to the viaduct which block off access to the station from the north or south along the viaduct.” It goes on to raise “significant concerns” about the building infront of the railway station “Firstly, the scale of the building and how it affects the generosity of Elephant Court which is severely restricted as a consequence and does not have the proportions of a civic square which a scheme of this scale will require. Secondly, ‘Elephant Court will be an importance entrance point for the railway station at the Elephant and Castle from the west. This includes the interchange from the new underground station at the Elephant and Castle peninsula. The Panel felt the current proposal does not demonstrate how this important transport interchange will be facilitated by the scheme and remained concerned that the new building will impede access to the railway station.” The panel raises significant concerns about the new Northern line entrance, which they felt “lacked visual presence on the street and is currently proposed as a simple single-storey shopfront – no different to a retail unit.” It also criticises Delancey’s public realm proposals; “In respect of the public realm, the Panel felt the current proposals lacked generosity. They noted that other significant schemes provided appropriate civic spaces and public realm on their sites and felt that the current proposal did not strike the right balance between pubic realm and built form to mitigate against the enormous scale of the proposal.” All in all then, while the application is an improvement on what was dreadful, there is still a way to go before it is fit for approval. The planning committee must hold firm and reject the application. A protest has been organised for the evening of the planning committee on 3 July – details here |

Kings College ‘Student Village’ Presentation 6.30pm Wednesday 27th June

NOTICE OF MEETING

Kings College ‘Student Village’ Presentation

6.30pm Wednesday 27th June

Globe House | Corner of Bermondsey Street & Crucifix Lane

KCL Student Village

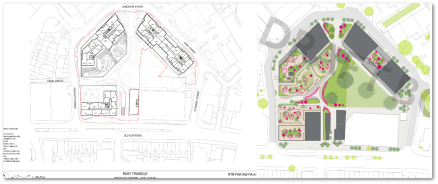

KCL are looking to develop a ‘Student Village’ on Talbot Yard (off Borough High Street)

KCL and their architects BDP show plans for Talbot Yard

King’s College and their lobbyists, Team London Bridge, have always aspired to, and collaborated with, high-rise plans for St Thomas St and the Guy’s/King’s Campus.

They have proposed presentation of their latest development plans for a new ‘student village’ to a Forum meeting, open to all. These plans were hitherto unknown to the community – certainly to us.

Please join us for the presentation by KCL and planner-architects, BDP, of their plans for a major new development centred on Talbot Street.

Click here to see a copy of the introduction letter from BDP which gives nothing away as to the exact location, height or appearance of the proposal, stating only that “In addition to approximately 420 new bed spaces and ancillary student facilities, the Student Village will also provide new commercial spaces at ground floor level.” On this basis it is unlikely to be a low-rise ‘village’.

Quill ++ and St Thomas Street ‘Masterplan’

Weston Street Elevation from the Quill++ Planning Application 18/AP/0900.

We are also inviting the Chair of Team London Bridge, Professor Simon Howell, to the meeting to explain the position of his main employer (King’s College of course) not just on his own high-rise plans but on their role the ’emerging masterplan’ for St Thomas Street.

We know that developers Greystar, CIT (South Bank Tower) and Threadneedle, and architects KPF (and now apparently BDP), have been in secretive collaboration with the council on this private vision for over a year. With the ultra-high-rise application for the Quill++ now relying upon it directly in their planning statements it is long overdue that the Council and TLB to come clean and consult the community on their ’emerging’ St Thomas Street masterplan.

The ‘St Thomas Street East’ Masterplan is referred to in the Quill++ Planning Application.

|

Extract from the GLA’s

Extract from the GLA’s